Getting To The Bottom Of Oklahoma Car Insurance

If you’re here, you’re about to discover clear, simple, and understandable auto insurance information all in one place. We’ve found everything you need to know from cheapest auto insurance companies to cheapest providers by driver type and more. If you live where the wind comes whipping down the plains or in the majestic mountains, this page is for you Oklahomans.

What Are You Looking For?

- Oklahoma’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Oklahoma Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What kind of auto coverage do you need in Oklahoma?

Oklahoma’s minimum coverage requirements stipulate that you must have bodily injury liability coverage, property damage liability coverage, and uninsured/underinsured motorist coverage to drive legally in the state. However, liability insurance only covers other parties’ damages from an accident you cause. In order for your own damages to be covered, you must add collision coverage and comprehensive coverage to your auto policy. You might also want to consider adding personal injury protection.

Read more:

- Steps To Take After A Hit-And-Run Incident In Oklahoma

- Understanding Uninsured Motorist Coverage: Essential Facts And Statistics

What are Oklahoma’s cheapest car insurance companies?

We looked at 10 cities and five driver profiles to calculate average premiums for 16 Oklahoma car insurance companies. Based on our research, Geico at the cheapest is about $2,000 less than the most expensive option. Take a look.

| Average Quote | |

|---|---|

| Geico | $1,075.60 |

| USAA | $1,274.56 |

| Safeco | $1,340.91 |

| Progressive | $1,488.65 |

| Mercury | $1,613.51 |

| Oklahoma Farm Bureau | $1,618.84 |

| Allstate | $1,631.11 |

| State Farm | $1,696.81 |

| Farmers | $1,707.00 |

| Shelter Insurance | $1,792.92 |

| CSAA Insurance | $1,944.37 |

| American National | $2,083.58 |

| Traders Insurance | $2,162.55 |

| Home State Insurance | $2,408.51 |

| Harbor Insurance | $2,481.30 |

| Liberty Mutual | $3,367.93 |

How much do drivers like you spend on auto insurance?

You’re you which by no means makes you average! That’s why we’ve taken the charts above a step further and have calculated rates by driver type. Teens, older couples, and retirees already don’t have a lot in common and you’ll find that car insurance rates are no different.

Cheapest For Teens

We’ve found the cheapest car insurance companies for teen guys and gals. USAA starts us off at the least expensive with Oklahoma Farm Bureau, and Geico not far behind.

| Average Quote | |

|---|---|

| USAA | $2,900.40 |

| Oklahoma Farm Bureau | $2,905.20 |

| Geico | $2,979.60 |

| Shelter Insurance | $3,397.00 |

| State Farm | $3,751.64 |

| CSAA Insurance | $3,842.67 |

| Allstate | $3,981.14 |

| Home State Insurance | $4,096.67 |

| Safeco | $4,281.00 |

| American National | $4,319.33 |

| Mercury | $4,362.00 |

*To come up with these premiums, we ran numbers for 16-year old boys and girls who only drive 7,500 miles a year and have clean records.

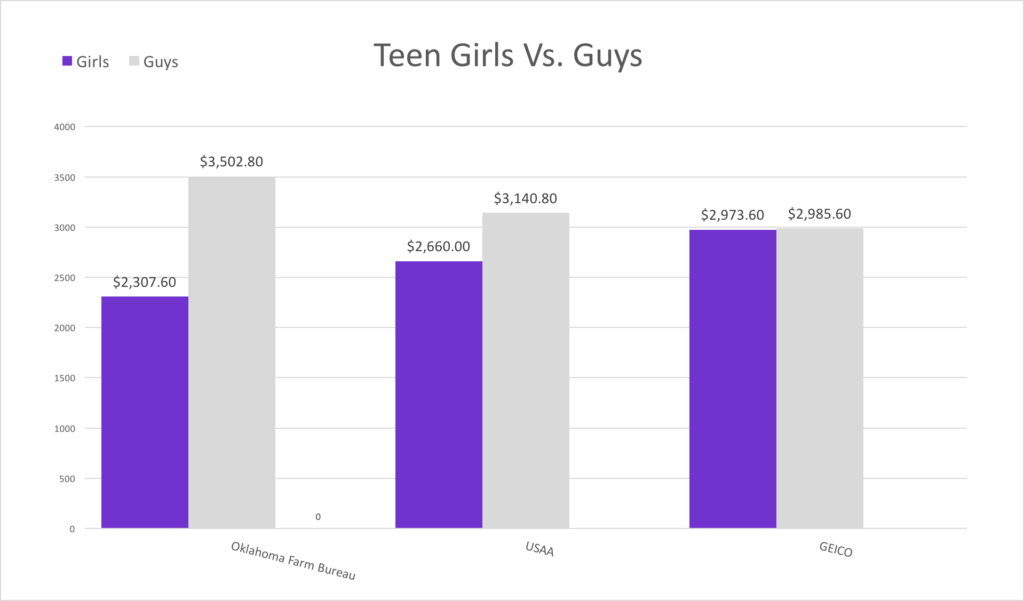

Not only does age affect your insurance rate, but so does gender. According to our analysis of average rates, Oklahoma teen girls will pay roughly 7.66% less than their male counterparts. This could be because teen boys are statistically more likely to be involved in an auto accident at this age, making them more of a risk for insurance companies to insure. For the three cheapest options for drivers, age 16, Geico is the only company with rates that are comparable for both men and women.

Cheapest For Drivers In Their 20s

Our research shows that when you turn 21, you could see a rate drop of almost 35% from when you were a 16-year old driver. This is because the older you get, the less risk you have tied to your profile, and companies auto insurance products may be tailored better for the more mature driving crowd. Safeco Insurance, for example, one of the more expensive options for teens is now the third cheapest. Here is where you’ll find the cheapest coverage as a 20-something driver.

| Average Quote | |

|---|---|

| Geico | $792.40 |

| USAA | $1,309.00 |

| Safeco | $1,436.40 |

| Allstate | $1,795.40 |

| Progressive | $2,236.90 |

| State Farm | $2,248.50 |

| Oklahoma Farm Bureau | $2,279.00 |

| Mercury | $2,368.40 |

| CSAA Insurance | $2,416.00 |

| Shelter Insurance | $2,452.00 |

| Farmers | $2,632.60 |

| American National | $3,112.40 |

| Home State Insurance | $3,127.60 |

| Harbor Insurance | $3,351.60 |

| Traders Insurance | $4,242.67 |

*All of these premiums were calculated by using the driver profile of 21-year old women and men.

Cheapest For Drivers Over 50

Not only does wisdom come with age, but so does cheaper auto insurance premiums. After looking at average rates for 55 and 70-year old men and women, we found that the cheapest Oklahoma car insurance policies come from Geico, USAA, and Safeco, with rates collectively being 38% cheaper than for drivers in their 20’s.

| Average Quote | |

|---|---|

| Geico | $546.60 |

| USAA | $695.57 |

| Safeco | $903.60 |

| Oklahoma Farm Bureau | $909.40 |

| Allstate | $1,018.60 |

| Shelter Insurance | $1,052.40 |

| State Farm | $1,073.00 |

| Progressive | $1,181.25 |

| CSAA Insurance | $1,186.70 |

| Farmers | $1,211.40 |

| Mercury | $1,264.40 |

| American National | $1,441.10 |

| Traders Insurance | $1,965.50 |

| Home State Insurance | $2,069.30 |

| Harbor Insurance | $2,253.60 |

| Liberty Mutual | $3,329.80 |

Read more: Cheapest Car Insurance for Drivers 50 and Over

Rate Comparisons By Age

In order to see how much car insurance rates fluctuate as you age, here’s an easy comparison chart to take a peek at. You’ll see that rates drop drastically from 16 to 21 and even more from there until 70.

| Age 16 | Age 21 | Age 36 | Age 55 | Age 70 | |

|---|---|---|---|---|---|

| Average | $3,369.69 | $2,182.21 | $1,389.33 | $1,253.87 | $1,320.89 |

| Allstate | $3,981.14 | $1,795.40 | $1,046.80 | $997.20 | $1,040.00 |

| American National | $4,319.33 | $3,112.40 | $1,669.00 | $1,641.00 | $1,241.20 |

| Geico | $2,979.60 | $792.40 | $512.80 | $488.00 | $605.20 |

| Liberty Mutual | N/A | N/A | $3,444.20 | $3,338.40 | $3,321.20 |

| Progressive | N/A | $2,236.90 | $1,355.20 | $1,107.80 | $1,254.70 |

| Safeco | $4,281.00 | $1,436.40 | $944.00 | $870.80 | $936.40 |

| State Farm | $3,751.64 | $2,248.50 | $1,262.60 | $1,155.00 | $991.00 |

| USAA | $2,900.40 | $1,309.00 | $772.27 | $677.00 | $714.13 |

| Home State Insurance | $4,096.67 | $3,127.60 | $1,861.40 | $1,840.80 | $2,297.80 |

| Shelter Insurance | $3,397.00 | $2,452.00 | $1,331.60 | $1,118.80 | $986.00 |

| CSAA Insurance | $3,842.67 | $2,416.00 | $1,279.60 | $1,121.60 | $1,251.80 |

| Farmers | N/A | $2,632.60 | $1,772.60 | $1,252.80 | $1,170.00 |

| Harbor Insurance | N/A | $3,351.60 | $2,066.40 | $2,066.40 | $2,440.80 |

| Mercury | $4,362.00 | $2,368.40 | $1,282.00 | $997.60 | $1,531.20 |

| Oklahoma Farm Bureau | $2,905.20 | $2,279.00 | $1,091.20 | $956.80 | $862.00 |

| Traders Insurance | N/A | $4,242.67 | $1,932.60 | $1,830.60 | $2,100.40 |

In addition to age, gender, and marital status, car insurance companies factor your credit score and driving record into your premium. If you have a poor credit history or bad driving record, make sure to ask about insurance discounts when you’re shopping for auto insurance quotes. Major insurers offer opportunities to save like the good student discount, safe driver discount, and the discount for taking a defensive driving course. You may also get a discount for bundling two types of insurance, like an auto insurance policy and a homeowners insurance policy. Discounts like these can significantly bring down your insurance costs. (For more information, read our “What You Need To Know About Auto Insurance Costs In Oklahoma“).

What are average rates in the cities?

You just did a ton of reading about how certain drivers pay different rates. How do we break it to you that depending on where you live in Oklahoma, you’ll pay a different rate too? I guess we just did, so we’re glad that’s over. Now take a look to see how in Lawton you’ll pay a couple hundred dollars less a year than just three hours away in Tulsa.

| Average Quote | |

|---|---|

| Lawton | $1,666.10 |

| McAlester | $1,691.60 |

| Woodward | $1,695.31 |

| Oklahoma City | $1,759.39 |

| Tulsa | $1,815.92 |

What are the most popular auto insurance companies in Oklahoma?

“Market share” shows the percentage of customers a company has compared to competitors.

State Farm, for instance, is the state’s most popular auto insurance provider writing policies for almost 25% of insured drivers. It’s not the cheapest option out there though. In fact, it’s Oklahoma’s eighth cheapest provider. But why would the most people go with a company that isn’t the cheapest? That’s the question to ask here.

See, market share can give you a lot of insight about a company since often times the most popular ones aren’t the cheapest. It could be that they offer great coverage and customer service that makes paying extra worth it to customers. Geico, the state’s cheapest provider, doesn’t even make the list for top market share.

It’s just something to think about when you’re looking for a provider because going for a company that’s all-around great is always a safe bet.

| Market Share | Average Premium | |

|---|---|---|

| State Farm | 24.39 | $1,696.81 |

| Farmers | 12.9 | $1,707.00 |

| Progressive | 7.26 | $1,488.65 |

| Allstate | 7.21 | $1,631.11 |

| Liberty Mutual | 6.48 | $3,367.93 |

| USAA | 5.97 | $1,274.56 |

| Geico | 5.69 | $1,075.60 |

| Oklahoma Farm Bureau | 4.83 | $1,618.84 |

| CSAA Insurance | 3.48 | $1,944.37 |

| Shelter Insurance | 3.45 | $1,792.92 |

What insurance carriers have the most customer complaints?

If you don’t have something nice to say, it’ll go into something called a “complaint index.” This is a report of all of the complaints a company gets compared to their market share. It’ll tell you how happy customers are as a whole or how discontent they seem to be.

Just remember, that the lower the number, the less complaints. USAA and CSAA are Oklahoma’s best for customer complaints because they have zeroes meaning few customers take issue with their accounts. Farmers is the worst on this list, but by no means is its index terrible. It just means Farmers get more complaints on average than USAA and CSAA.

The reason we’re telling you this is because if customer satsifaction is highly important to you, this index can give you an indication of what you can expect.

| Complaint Index | |

|---|---|

| USAA | 0 |

| CSAA | 0 |

| Progressive | 0.006 |

| Shelter | 0.013 |

| State Farm | 0.016 |

| Geico | 0.016 |

| Liberty Mutual | 0.022 |

| Oklahoma Farm Bureau Mutual | 0.026 |

| Allstate | 0.026 |

| Farmers | 0.052 |

What do we recommend?

We’re not you, so we’re not going to be making any decisions for you. All we want to do is give you all the information you need to decide on an auto insurance company confidently. The thing we do tell all of our readers though is that you should always choose an insurance provider that ranks well across multiple categories.

For Oklahoma, Progressive ranked in the top five for market share, pricing, and low complaints. That means it’d be a great choice for most drivers unless you’re looking for something specific that they don’t offer. USAA and State Farm are close seconds to Progressive because they rank in the top 15 for all categories, but not as well as Progressive.

If you live in the Sooner State and want to find answers and quotes sooner, let agents help you out. They happen to be pretty good with rate calculating and question answering. Plus, they’re nice to talk to. Call to talk to an insurance agent now and get help finding the cheapest rates for the insurance coverage you need.

Where We Found The Facts

We found all these facts fair and square after digging for hours and hours online. The only thing we did on our own was come up with premium averages. While they’re all true to those driver profiles, you might not be the perfect match for those categories, so your quotes might be different when you start shopping. We just wanted to give you a good idea of what to expect for certain age groups and cities, so that’s why we included them.

Source Links:

- Oklahoma Department of Insurance

- valuepenguin.com