Our goal is to show you the most affordable insurance companies in Rhode Island. So if you are from the Ocean State and have your sailing legs, this is the page for you.

We know how time consuming it can be to waffle through different insurance companies to find the cheapest option. To save you time and money, we’ve gathered the information for you all in one place. We’ve broken it up into demographic sections so you can get a better idea of how much others in your state are paying for their insurance. Some of the demographics we focused on are address, age, and marital status. This way you can pick the company that best suits your needs and your wallet.

What are you looking for?

- Overall Cheapest in Rhode Island

- How Much Drivers Like You Spend On Auto Insurance

- Cost by City

- Most Popular

- Customer Satisfaction Ratings

- Our Recommendation

What is the minimum coverage required in Rhode Island?

Rhode Island’s minimum coverage requirements call for bodily injury liability coverage, property damage liability coverage, and uninsured/underinsured motorist coverage.

Many drivers need more than the minimum requirements for liability insurance in the state. It’s highly recommended that you add collision coverage and comprehensive coverage to your auto policy, and if you’re leasing your car, these coverages may even be required by your lender.

Most major car insurance companies offer numerous additional coverage options as well, such as GAP insurance, roadside assistance, and personal injury protection. Keep in mind that optional coverages you add will increase your auto insurance rates.

Don’t settle for a minimum coverage policy and leave yourself unprotected.

Read more: Gap Insurance In Massachusetts Is The Right Choice For You

What are Rhode Island’s most affordable car insurance companies?

We looked at nine auto insurance companies, four cities, and eight different driver profiles (single, married, male, female, etc.) so you know what to expect and where to look for the cheapest auto insurance.

Rates vary from driver to driver because they depend on driving habits, age, sex, and more–but these averages should give you an indication of where you may find the cheapest auto insurance. Standard liability coverage in Rhode Island is 25/100/25 which refers to what the insurance will pay someone else for injuries and property damage in an accident you caused. Whatever coverage you go with should give you security no matter what happens to your car.

Our research found that Progressive is the overall cheapest, with rates roughly $78 a month. At only $200 more than Progressive,Travelers came in with the second most affordable rates.

| Average Premium | |

|---|---|

| Progressive | $941.33 |

| Travelers | $1,193.92 |

| Allstate | $1,300.08 |

| Nationwide | $1,548.24 |

| Geico | $1,872.58 |

| MetLife | $1,986.50 |

| Liberty Mutual | $1,995.58 |

| Peerless Insurance Company | $2,043.00 |

| Amica Mutual | $2,144.17 |

*To provide you with reliable data, we haven’t included any averages from 18-year-olds in our overall analysis. Nationwide didn’t provide rates for this age group, which made their rates look lower.

How much do drivers like you spend on Rhode Island car insurance?

Because everyone has different driving habits, it makes sense that there are several different factors that go into your final insurance quote. Things like age, gender, and driving history are just a few of the factors that can make your monthly or annual rate go up or down. We are dedicated to giving you the closest quote possible, so we broke up the data into categories, such as millennials. This way you can see what you’ll be paying based on who you are and not who your neighbor is.

Cheapest for Millennials

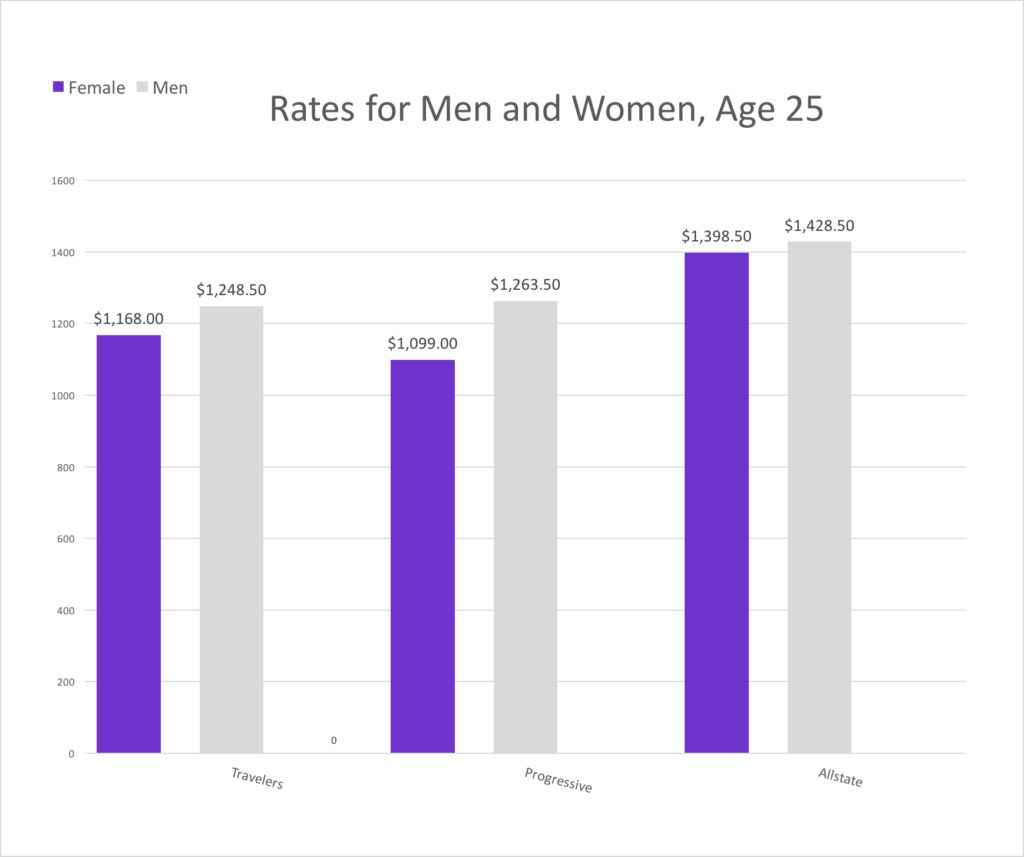

We looked at 25-year-old men and women, and we found that Progressive, Travelers, and Allstate are your cheapest options. Average prices are close—Progressive is only $27 cheaper than Travelers—so make sure you consider the details that matter to you before deciding. If you are a 25-year-old woman, you will also pay 7% less than a man of the same age according to our research. One exception: Geico is the only carrier that charge men less than women.

| Average Premium | |

|---|---|

| Progressive | $1,181.25 |

| Travelers | $1,208.25 |

| Allstate | $1,413.50 |

| Nationwide | $1,886.00 |

| MetLife | $1,986.50 |

| Amica Mutual | $2,271.00 |

| Peerless Insurance Company | $2,278.50 |

| Geico | $2,367.75 |

| Liberty Mutual | $2,375.75 |

Cheapest for Drivers over 60:

The good news is that the older you get, the lower your car insurance rates tend to be. According to our driving sample, Progressive is less than $70 a month for men and women who are over 60. You’ll also get a price cut if you are married, so there are savings from multiple factors for this demographic.

| Average Premium | |

|---|---|

| Progressive | $806.00 |

| Travelers | $1,180.25 |

| Allstate | $1,268.75 |

| Nationwide | $1,409.43 |

| Geico | $1,649.75 |

| Liberty Mutual | $1,817.50 |

| Amica Mutual | $2,086.50 |

| Peerless Insurance Company | $2,111.25 |

Cheapest for Married Drivers:

Because married drivers are often seen as less risky than single drivers, married men and women ages 40 to 60 enjoy lower rates. Progressive, Travelers and Allstate are the three cheapest companies, but the gap between the prices encompass a larger range. Keep in mind that your driving history comes into play here, but you can be eligible for multiple driver discounts since there are two of you. The less risky driver you and your spouse are, the cheaper your insurance will be. So if you’ve been a responsible driver, you’ll see lower rates.

| Average Premium | |

|---|---|

| Progressive | $821.38 |

| Travelers | $1,186.75 |

| Allstate | $1,243.38 |

| Nationwide | $1,475.86 |

| Geico | $1,625.00 |

| Liberty Mutual | $1,805.50 |

| Peerless Insurance Company | $1,925.25 |

| Amica Mutual | $2,080.75 |

In addition to age, gender, and marital status, car insurance companies factor your credit score and driving record into your premium. If you have a bad credit history or bad driving record, make sure to ask about insurance discounts when you’re shopping for auto insurance quotes. Major insurers offer opportunities to save like the good student discount, safe driver discount, and the discount for taking a defensive driving course. You may also get a discount for bundling two types of insurance, like an auto insurance policy and a homeowners insurance policy. Discounts like these can significantly bring down your insurance costs.

You should also ask any potential insurance provider if they offer accident forgiveness, as this can save you money down the line.

What are average rates in the cities?

Although Rhode Island only spans 37 miles east to west and 48 miles north to south, insurance rates can vary drastically within the state. If you live in East Providence for example, your annual rates are almost $750 less than Providence. Keep in mind that the data shown here includes rates for teen drivers, which are significantly higher than other age groups.

| Average Premium | |

|---|---|

| East Providence | $2,721.60 |

| Warwick | $2,831.48 |

| Pawtucket | $3,064.73 |

| Providence | $3,456.49 |

What are the most popular auto insurance companies?

Progressive is not only the most affordable insurance company, but the most popular as well. Although Travelers is consistently one of the cheaper options, it ranks tenth in popularity. But, Amica Mutual is consistently more expensive, yet it’s in the top five for popularity. Different factors come into play here such as convenience, and other discounts offered by each company. Allstate and Geico also aren’t cheaper options but rank high in popularity, so you should ask yourself why? Consider your personal needs and motivation, because different variables come into play before you get the final price.

| Market Share Percent | |

|---|---|

| Progressive | 17.74 |

| Allstate | 12.65 |

| Geico | 11.71 |

| Amica Mutual | 11.54 |

| MetLife | 8.44 |

| Liberty Mutual | 7.99 |

| Nationwide | 6.57 |

| USAA | 5.15 |

| MAPFRE | 3.69 |

| Travelers | 3.11 |

What companies have the best customer service?

Out of the most popular companies in Rhode Island, Amica Mutual has the best customer satisfaction rating ratio at 0.03. The complaint ratio tells us how many consumer complaints an insurer receives per $1 million in sales. But smaller companies such as 21st Century and Selective Insurance didn’t have a complaint recorded in 2014. This way you can trust that the company you choose will likely treat you just as well as they treat their other customers.

| Complaint | Premiums Written | Complaint Ratio | |

|---|---|---|---|

| Selective Insurance | 0 | $10,089,460.00 | 0 |

| Hartford | 0 | $5,402,735.00 | 0 |

| 21st Century | 0 | $3,823,802.00 | 0 |

| Harleysville Insurance | 0 | $3,053,219.00 | 0 |

| Encompass | 0 | $2,173,619.00 | 0 |

| EMC Insurance | 0 | $2,045,114.00 | 0 |

| NLC Insurance | 0 | $1,991,585.00 | 0 |

| Michael Karfunkel Grantor Annuity Trust | 0 | $1,710,211.00 | 0 |

| MiddleOak | 0 | $1,668,965.00 | 0 |

| Farm Family | 0 | $1,563,395.00 | 0 |

| Horace Mann | 0 | $1,434,135.00 | 0 |

| Markel Insurance | 0 | $1,091,946.00 | 0 |

| Amica | 3 | $87,570,645.00 | 0.03 |

| MAPFRE Insurance | 1 | $28,000,885.00 | 0.04 |

| Travelers | 1 | $23,622,945.00 | 0.04 |

| Progressive | 10 | $134,626,018.00 | 0.07 |

| Providence Mutual Fire Insurance Company | 1 | $9,833,058.00 | 0.10 |

| Nationwide | 5 | $46,795,703.00 | 0.11 |

| MetLife | 7 | $64,094,187.00 | 0.11 |

| USAA | 5 | $39,103,522.00 | 0.13 |

| Quincy Mutual Fire Insurance Company | 1 | $6,855,894.00 | 0.15 |

| Main Street America Insurance | 2 | $12,374,969.00 | 0.16 |

| Allstate | 15 | $83,001,278.00 | 0.18 |

| Geico | 18 | $88,861,402.00 | 0.20 |

| State Farm | 1 | $4,433,383.00 | 0.23 |

| Liberty Mutual | 14 | $60,661,346.00 | 0.23 |

| Ohio Mutual Insurance Company | 2 | $8,255,123.00 | 0.24 |

| Esurance | 4 | $10,816,493.00 | 0.37 |

| National General | 3 | $6,558,519.00 | 0.46 |

Read more: Top Choice For Your Mapfre Insurance Review

What do we recommend?

If your main concern is price, Progressive is our choice. Besides being the cheapest, it is also the most popular and delivers quality customer service. Travelers and Allstate are also good overall choices. Travelers isn’t as popular, but ranks cheaper, and Allstate ranks low in complaints.

If your main concern is good customer service, Amica Mutual is a good choice. Although it’s more expensive, it is still one of the most popular. Keep in mind that some companies give different discounts that could make insurance cheaper for you. It doesn’t hurt to get a specific quote from several companies before deciding. No matter which Insurance company you choose, we want you to have all the facts up front.

Read more: Comparing Amica And Progressive: Which Insurance Provider Is Right For You?

How did we find this information?

We looked at the different companies and different driver profiles within Rhode Island to give you the best overall idea of what you will be paying. Because your rate is unique to you, this information is meant to give you a general idea of what to expect. You can then compare quotes from several companies to see which can give you the cheapest car insurance rate. Requesting a quote from a company will also give you a good feel for their customer service so you will know what to expect farther down the road.

Source Links:

- Rhode Island Department of Business Regulation

- Rhode Island Division of Motor Vehicles

- Rhode Island Department of Transportation