From specialty rates for specific Idaho drivers to the cheapest auto insurance providers, now you can find it all in one place. If you think your state’s famous tubers are totally tubular (we’re talking about potatoes), this is the car insurance information page for you.

What Are You Looking For?

- Cheapest Companies In Idaho

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Car Insurance Companies In Idaho

- Customer Satisfaction Ratings

- Our Recommendation

Where Can You Find Cheap Car Insurance in Idaho?

Idaho’s car insurance premiums are almost too good to be true they’re so low. Safeco comes in as the clear winner, with its average annual rates amounting to only $15 a month according to our analysis. Even Progressive, which tops our list as the most expensive out of the companies we looked at, comes in way below the national average. Based on our research, the lowest rates can be found at the following companies:

| Average Annual Premium | |

|---|---|

| Safeco | $179.40 |

| Geico | $607.85 |

| Farmers | $615.65 |

| American Family | $652.60 |

| Allstate | $724.70 |

| Progressive | $901.85 |

*We calculated these premiums based on drivers who have a 2013 Honda Civic LX (4-door), good credit, and no accidents.

How Much Do Drivers Like You Spend on Auto Insurance?

Not every person is the same. That’s what makes people so interesting! We took a look at different driver profiles to come up with some sample premiums for you. Keep in mind, rates can vary for each person based on different criteria. Depending on the differences, one company that’s more expensive for our sample insured could be cheaper for you. This is why it’s so important to get quotes on collision coverages and any other coverages you want. Check it out below.

Cheapest For Teens

Teen drivers have a distinct lack of experience that makes them riskier. They get in more accidents, are more easily distracted, and get more tickets. That’s not an opinion, it’s just the truth, based on statistics. Insurance companies are well aware of this. So it usually costs more to insure yourself with auto coverage as a teen than it does as as an adult. Don’t worry though. We found the cheapest options in Idaho for you based on rates from 18-year old girls and boys.

| Average Annual Premium | |

|---|---|

| Safeco | $195.00 |

| Farmers | $543.80 |

| Geico | $667.20 |

| Allstate | $704.00 |

| American Family | $1,014.80 |

| Progressive | $2,158.57 |

Cheapest For Young Adults

Your rates will drop about 18% from your 18th to 25th birthday assuming you keep a relatively clean driving record. American Family and Progressive offer even bigger rate changes, 40% and 55.75% respectively. We looked at 25-year old dudes for these rate calculations, but if you’re in your 20s, you might pay something close to these premiums based on our research.

| Average Annual Premium | |

|---|---|

| Safeco | $190.80 |

| American Family | $608.20 |

| Farmers | $657.60 |

| Geico | $692.00 |

| Allstate | $825.60 |

| Progressive | $954.46 |

Cheapest For Drivers Over 60

As you age, you’ll usually get better auto insurance rates. While Progressive is the sixth cheapest for drivers on average, it’s the second most affordable for drivers over 60 at just about $400 a year. That’s really cheap, but check out the chart to see where you could potentially save more on auto coverage.

| Average Annual Premium | |

|---|---|

| Safeco | $165.60 |

| Progressive | $401.20 |

| American Family | $467.00 |

| Geico | $510.40 |

| Farmers | $585.00 |

| Allstate | $664.40 |

How Do Rates Differ By Marital Status?

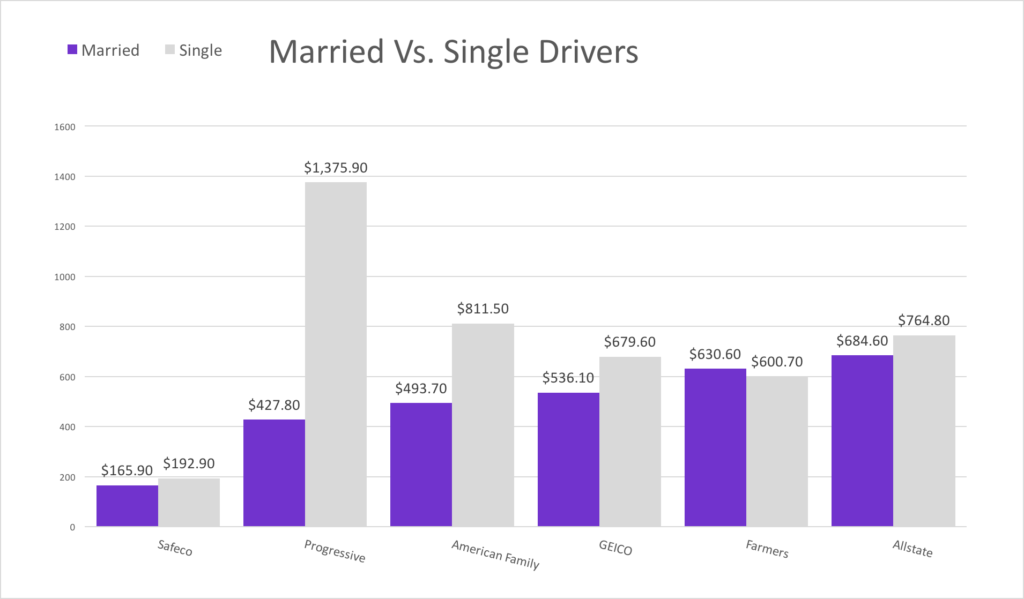

Most singles pay more for auto coverage than your married peers. Progressive has drastic pricing differences about 200% higher rates for singles than a married couple. Some insurance companies may see marriage as a sign of stability. Many times, it comes down to things like age and the fact that a married couple might be more likely to own a home and have more than one type of insurance policy they can bundle with one carrier.

Farmers is on your side though if you’re single because it’s the only Idaho car insurance provider that doesn’t charge singles more. You’ll actually pay less! Either way, take a look to see how rates can change depending on your marital status.

Does Your City Affect Your Comprehensive Coverage Rates?

Whether you’re living large in the big city of Boise or laying low in the country, you’ll most likely pay different average rates than your neighbor. See for yourself by checking out the chart so you’ll know what to expect depending on where you’re car insurance shopping.

| Average Annual Premium | |

|---|---|

| Boise | $545.67 |

| Meridian | $568.92 |

| Post Falls | $592.58 |

| Coeur d'Alene | $598.08 |

| Lewiston | $614.08 |

| Pocatello | $616.58 |

| Twin Falls | $640.67 |

| Idaho Falls | $643.58 |

| Caldwell | $656.50 |

| Nampa | $660.08 |

Who Are The Most Popular Idaho Car Insurance Providers?

Car insurance companies compete with all the other providers in a region. Depending on what they offer, how much their policies are, and how they treat customers, they get a certain “market share.” Despite what some might think, the lowest rate doesn’t always win. This measurement shows the percentage of customers a company has compared to competitors.

You can use this information to analyze an auto provider on a whole new level. In Idaho, State Farm is the most popular company according to market share and our research. It’s written over 100,000 policies, but it didn’t rank on the cheapest options. Farm Bureau is another popular company, but also didn’t rank for cheapest offerings.

This is the part where you ask yourself, “why?” Market share is really valuable to look at because it suggests that a company may be popular for other reasons than cost. It’s just something to think about when you’re insurance shopping.

| Premiums Written | MarketShare | |

|---|---|---|

| State Farm | 106,973 | 14.51 |

| Farm Bureau | 79,343 | 10.76 |

| Farmers | 78,782 | 10.68 |

| Allstate | 70,365 | 9.54 |

| Liberty Mutual | 69,014 | 9.36 |

| Geico | 66,614 | 9.03 |

| Progressive | 64,374 | 8.73 |

| USAA | 35,846 | 4.86 |

| American Family | 20,850 | 2.83 |

| Nationwide | 16,317 | 2.21 |

Read more: Everything You Need To Know About Auto Insurance Costs In Idaho

Customer Complaints

A “complaint index” measures the percentage of customers who complain about a company compared to its market share. What you need to know about it is that if a company has a lower complaint index, it means its customers aren’t complaining as much. If it has a higher number, it’s not a good thing.

Progressive through Liberty Mutual all have zeroes which is excellent as far as low customer complaints. Viking is downright awful with that high of a customer complaint number. If you’re on the fence about a company, make sure they have a reasonable complaint index so that you’re more likely to be happy with them.

| # of Complaints | Index | |

|---|---|---|

| USAA | 0 | 0 |

| USAA Casualty | 0 | 0 |

| Geico Choice Insurance | 0 | 0 |

| MetLife | 0 | 0 |

| Allstate Insurance | 0 | 0 |

| Geico Advantage | 0 | 0 |

| Auto Owners Insurance | 0 | 0 |

| Liberty Mutual | 0 | 0 |

| Farm Bureau Mutual | 1 | 0.37 |

| Farmers | 1 | 0.43 |

| Allstate Fire & Casualty | 1 | 0.66 |

| Progressive Northwestern | 1 | 0.72 |

| State Farm | 3 | 0.92 |

| American Family | 1 | 1.46 |

| Safeco | 3 | 1.69 |

| Geico Ind. | 1 | 2.26 |

| State Farm Fire & Cas Co | 1 | 2.77 |

| Geico General | 3 | 4.24 |

| Viking Insurance | 3 | 5.65 |

*If you’re wondering why or how Geico and other insurers could have different numbers here, it’s because insurance groups write policies under more than one company name per state. The above numbers are by company, and not by group.

Our Recommendation

We’re not here to tell you what to do like a bossy parent. We hope you’ll take the information on this page to weigh the personal pros and cons you have with each company.

We will recommend that when wearing your thinking cap, you pick an auto insurance provider that has good standings across multiple categories. What we mean is for you to pick something like Progressive or Allstate because they have good standing across market share, premium cost averages, and complaint index. The choice is up to you about which company you like best, but picking one with overall greatness will give you better odds of being happy with their service.

Where We Found The Facts

What you read here might not be true to you. For all of these premium averages, we used driver profiles of people who had a 2013 Honda Civic LX (4-door), good credit, and no accidents. You might have two out of the three of those things, but still get a different number when you call. Just know that every driver is different and these numbers are there to help you see an example of what your premium could be. The only way to know for sure is to call and get a quote tailored to you!

Source Links:

- Idaho Department of Insurance

- ValuePenguin.com