You guys keep coming back for simple, understandable, and complete insurance information and we’ll keep on spending time collecting the data for it! That’s because we like to set you up with all the auto insurance information you need to make a smart decision. If you can tell the difference between a “Nor’Dakotda” accent and those of Minnesotans, and say, “Dontcha know,” this car insurance information is for you.

What Are You Looking For?

- Cheapest CompaniesIn Minnesota

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Minnesota Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are the cheapest auto insurance companies In Minnesota?

We calculated premiums for 10 insurance companies based on 10 cities, and eight driver profiles of people with 50/100/100 coverage ($50,000 bodily injury liability per person, $100,000 bodily injury liability per accident, $100,000 property damage liability), a 2013 Honda Civic LX (4-door), good credit, and no accidents. Take a look and see what auto insurance coverage might run you in Minnesota.

| Minnesota's Cheapest Companies | Average Annual Rate |

|---|---|

| Travelers | $678.93 |

| American Family | $1,066.45 |

| Western National | $1,113.15 |

| AAA | $1,121.00 |

| Farmers | $1,498.55 |

| Geico | $1,973.55 |

| Allstate | $1,980.70 |

| Allied | $2,388.63 |

| MetLife | $3,066.63 |

| Liberty Mutual | $3,374.87 |

Read more: Minnesota Car Insurance Requirements

*We looked at 10 companies, 10 cities, and eight driver profiles for this average.

How much do drivers like you spend on auto insurance?

The Land of 10,000 Lakes is also one full of different car insurance quotes. Depending on whether you’re a teen or 40-year old driver, you’ll pay a unique premium. Take a look at the premiums we’ve calculated for specific age groups below.

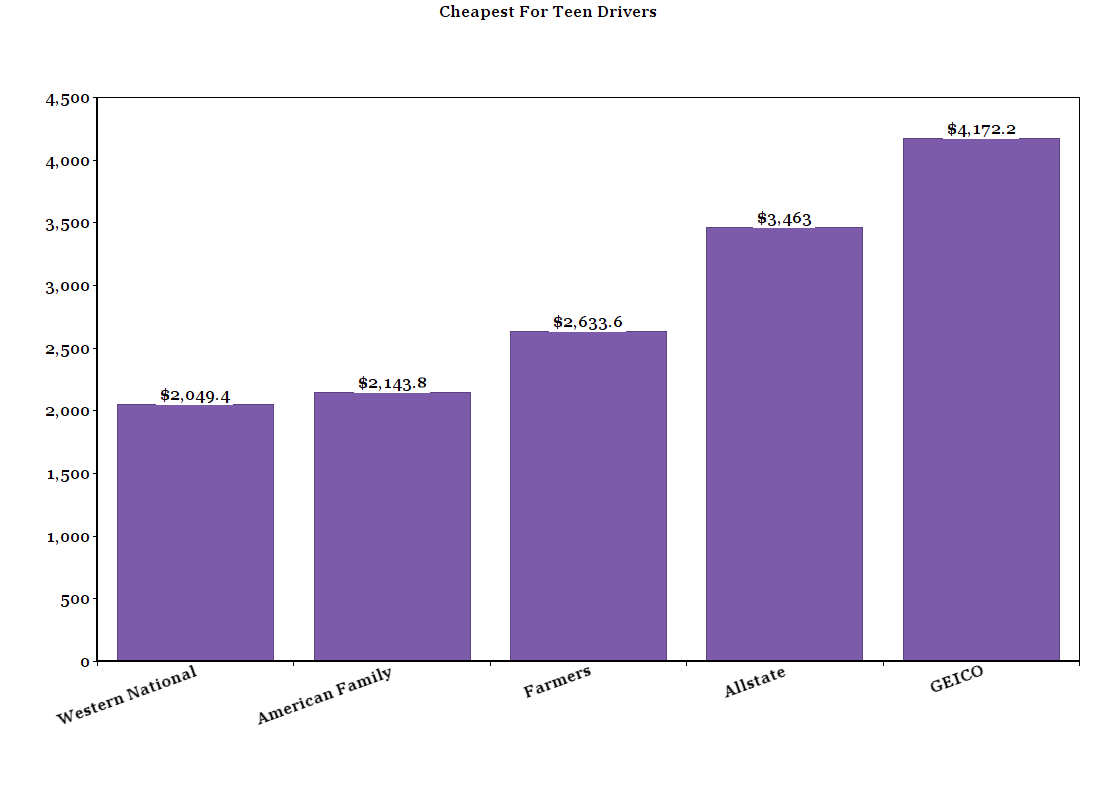

Cheapest For Teen Drivers

Male teens pay about 23% more than girls your age. It’s because male drivers get into more accidents statistically speaking. Despite this rate discrepancy, we did do some math to find the most affordable coverage rates in Minnesota for 18-year old girls and boys. Have a look below.

*AAA, Travelers, and Liberty Mutual didn’t provide quotes for this age group probably because they aren’t preferred customers.

Cheapest For Families

This group has a huge range of prices depending on the insurance carrier. While you can find car coverage under $700 for three companies, you’ll also sky rocket to over $3,000 for Liberty Mutual. We based this off of drivers who were 40 and 60-years old and married, but it’ll give you a good idea of what families are paying for auto coverage in Minnesota.

Most Affordable for Families Average Annual Rate

Travelers $664.40

American Family $675.30

Western National $689.80

Farmers $987.90

AAA $1,040.80

Geico $1,206.30

Allstate $1,311.80

Allied $1,768.60

Liberty Mutual $3,240.50

If you’re having trouble finding affordable auto insurance because of poor credit or a bad driving record, make sure to ask about any insurance discounts you might be entitled to. Many auto insurance providers offer senior discounts and good student discounts, which can help offset high rates due to age. You might also find a provider with a military discount or a rewards program that offers discounts for being a safe driver. Insurance discounts can significantly bring down the cost of coverage.

What are average rates in the cities?

Your car insurance premium is always based off of thousands (and some cases, millions!) of data points that help car insurance companies calculate risk. In short, it means you’ll likely pay a different rate than your neighbors do. Plymouth and Brooklyn Park are both suburbs of Minneapolis, but they pay much different rates. This is why you should take a look at the table below.

| Cheapest Cities for Insurance | Average Annual Rate |

|---|---|

| Plymouth | $1,561.25 |

| Rochester | $1,583.65 |

| Duluth | $1,651.94 |

| Bloomington | $1,654.88 |

| Eagan | $1,661.94 |

| Woodbury | $1,701.12 |

| Osseo | $1,752.53 |

| Brooklyn Park | $1,788.53 |

| St. Paul | $2,110.81 |

| Minneapolis | $2,139.00 |

What are the most popular Minnesota auto insurance providers?

When we say “popularity,” what we mean in our heads is “market share” or the percentage of customers a company has compared to its competitors. It’s a great means to measure hidden things about a provider that may not meet the eye.

Take our data on State Farm for instance. It has almost one quarter of all insured drivers in Minnesota on its policies. It didn’t rank in the top 10 for cheapest auto policies though. Same with Progressive which came in second for market share based on our research. It isn’t on the list for cheapest car insurance companies. Travelers the cheapest option in Minnesota for the average driver according to our findings isn’t even on this list either. The question to ask here is why more customers are going to certain insurance providers if they’re not the cheapest option. The answer might be great customer service and coverage are worth the cost. Take a look to decide for yourself.

| Premiums Written | Market Share Percent | |

|---|---|---|

| State Farm | 758,581 | 24.51 |

| Progressive | 443,469 | 14.33 |

| American Family | 343,901 | 11.11 |

| Farmers | 231,435 | 7.48 |

| Allstate | 181,153 | 5.85 |

| Liberty Mutual | 116,805 | 3.77 |

| Geico | 90,408 | 2.92 |

| Auto Owners Group | 86,663 | 2.8 |

| USAA | 84,500 | 2.73 |

| Nationwide | 79,413 | 2.57 |

What companies have the best customer service ratings?

A “complaint index” is the percentage of customers who complain compared to a company’s market share. It’s also another fantastic way to see what a car insurance company is like before you bite the bullet and sign a policy. Lower numbers mean less complaints and higher numbers mean more unhappy customers. Farmers is the best at keeping customers happy in Minnesota according to our data, while Auto Club Insurance is the worst. As long as a score is below 1.0, they’re usually pretty good though.

| # of Complaints | Complaint Index | |

|---|---|---|

| Farmers | 7 | 0.028 |

| USAA | 5 | 0.065 |

| Progressive | 34 | 0.083 |

| State Farm | 106 | 0.151 |

| Geico | 13 | 0.158 |

| Liberty Mutual | 20 | 0.178 |

| American Family | 86 | 0.256 |

| Auto-Owners | 23 | 0.27 |

| Allstate | 46 | 0.286 |

| Auto Club Insurance Association Group | 32 | 0.416 |

What do we recommend?

We have a few recommendations: one, that you make up your own mind, two, that you consider all possibilities for auto coverage, and three, that you pick a provider that’s great across the board.

Farmers is an example of a great car insurance provider in Minnesota. Based on our data, it ranks number one in customer service (complaint index), number four for market share, and number five for cheapest rates. Go with a company like that and you should be in good shape.

If you need help, there are a ton of agents waiting by the phones for your calls so they can help you find answers to questions and great quotes too. Give them a call today to get started.

Where We Found The Facts

We want to give you information you need to make better car insurance choices. The one thing that may not work for you though is the premium amounts we calculated. We based our coverage average off of Minnesota drivers with 50/100/100 coverage, a 2013 Honda Civic LX (4-door), good credit, and no accidents. If this isn’t you to a tee, you’ll probably get a different rate when you call for a quote. This information is simply here to help give you an idea of what you’ll pay for auto coverage.

Source Links:

- ratekick.com