Exploring Vermont Car Insurance

Car insurance researching and shopping shouldn’t be a pain. That’s why we’ve taken it upon ourselves to do the dirty work for you. We’ve found everything you Vermonters need to know about car insurance from cheapest companies to the most popular auto coverage providers. If you love finding car insurance information as easily as you love your fall foliage, this is the page for you.

What Are You Looking For?

- Vermont’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Vermont Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

Vermont’s Cheapest Companies

We did some research on 10 cities with drivers who have a 2013 Honda Civic LX (4-door), good credit, and no accidents on record to bring you the cheapest car insurance companies. Safeco is way low, at just $212 on average for annual premiums. Union Mutual Fire Group is over $1,000 more expensive. Take a look so you can see where you might be able to find the cheapest car insurance in Vermont.

| Cheapest in Vermont | |

|---|---|

| SAFECO | $212.52 |

| TRAVELERS | $556.15 |

| PROGRESSIVE | $563.77 |

| NATIONWIDE | $629.33 |

| Geico | $658.52 |

| Co-Operative Ins Companies | $664.37 |

| ALLSTATE | $1,012.52 |

| METLIFE | $1,139.33 |

| Concord Group | $1,140.22 |

| Union Mutual Fire Group | $1,672.23 |

*These averages don’t include rates for 18-year old drivers because we weren’t able to obtain that information.

How Much Drivers Like You Spend On Auto Insurance

Average isn’t an adjective that fits every person. We got even more specific with our data research to bring you cheapest car insurance companies for a variety of driver types. Give it a look.

Cheapest For Teens

Teens are a very specific driving group that will pay a much different rate than middle aged married couples and other people. To help you find the cheapest insurance for your age group, we calculated premiums based on your demographic. Here are the companies where we found the cheapest coverage on average.

| Cheapest for Teens | |

|---|---|

| SAFECO | $680.89 |

| Geico | $1,961.56 |

| ALLSTATE | $2,319.33 |

| TRAVELERS | $3,048.00 |

| Co-Operative Ins Companies | $3,124.67 |

| METLIFE | $3,614.22 |

| Concord Group | $4,309.33 |

| PROGRESSIVE | $4,571.33 |

| Union Mutual Fire Group | $8,158.00 |

Read more: Finding The Best Auto Insurance For Married Couples

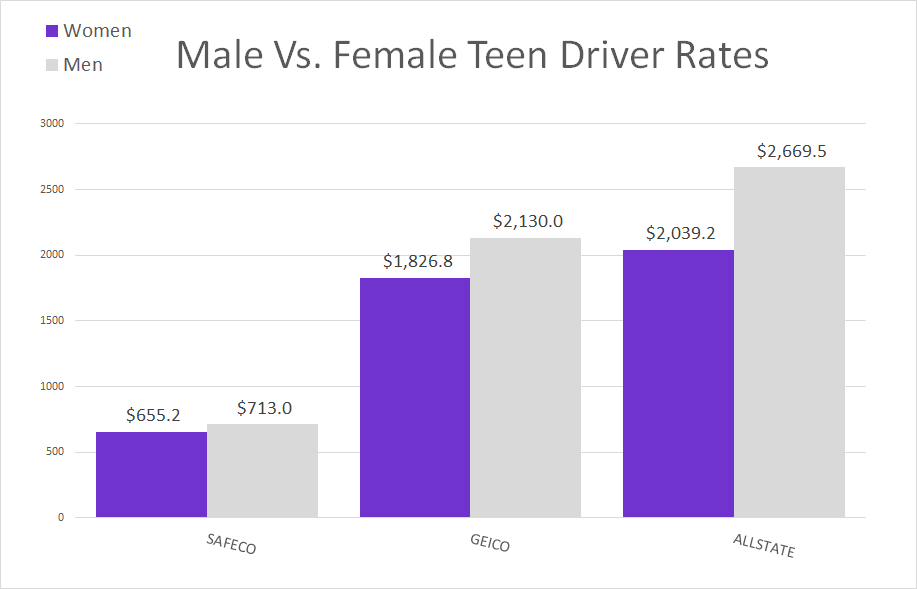

How Rates Differ For Male And Female Teen Drivers

Based on driver profiles of 18-year old men and women, we found that guys pay about 25% more than females. This is probably due to the fact that young male drivers statistically get into more accidents that females. Regardless, take a look at where male and female teens can find the cheapest insurance and how the rates differ.

Cheapest For Young Adults

People under 25 are also a unique group that warrant their own rate average information. Once you turn 25, you’ll see a big drop in auto insurance rates, but here are the cheapest on average for you Vermont youngsters.

| Cheapest for Young Adults | |

|---|---|

| SAFECO | $227.78 |

| TRAVELERS | $626.67 |

| PROGRESSIVE | $651.50 |

| NATIONWIDE | $727.78 |

| Geico | $727.78 |

| Co-Operative Ins Companies | $848.67 |

| METLIFE | $1,139.33 |

| ALLSTATE | $1,148.22 |

| Concord Group | $1,275.56 |

| Union Mutual Fire Group | $1,960.22 |

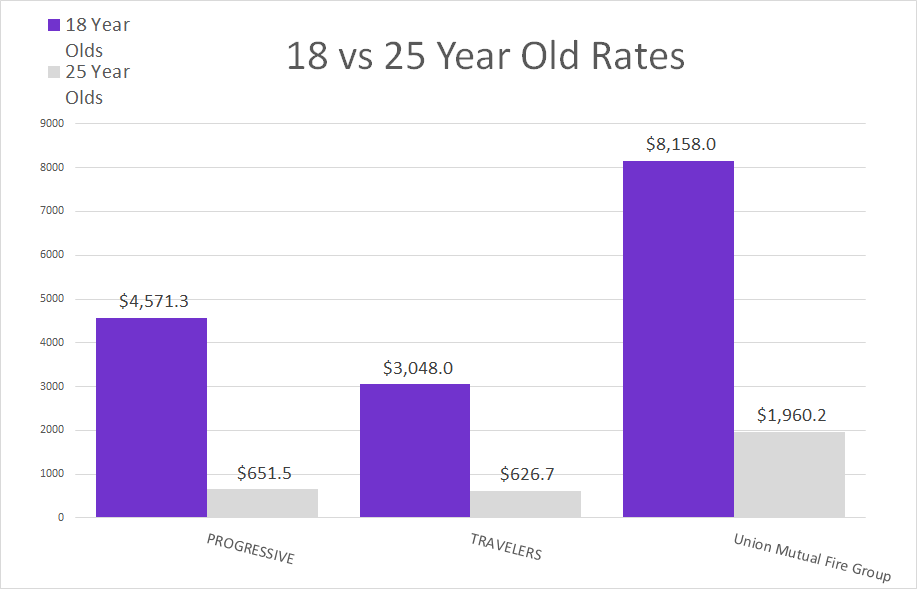

| 18 Year Olds | 25 Year Olds | ||

|---|---|---|---|

| PROGRESSIVE | $4,571.33 | $651.50 | -86% |

| TRAVELERS | $3,048.00 | $626.67 | -79% |

| Union Mutual Fire Group | $8,158.00 | $1,960.22 | -76% |

How Rates Differ For Young Drivers

After looking at driving information for 25-year old drivers, we found that rates actually plummet 70% from when they were teens. If you’re looking for big savings once you turn 25, here are the three Vermont auto insurance providers with the biggest rate differences.

Cheapest For Married Couples

In order to come up with these premium averages for car insurance, we ran numbers for married couples who were 40 and 60. Safeco is in the top again for cheap coverage and once again, there is a disparity of over $1,000 between the cheapest and most expensive options. See for yourself below.

| Most Affordable for Married Couples | |

|---|---|

| SAFECO | $204.89 |

| TRAVELERS | $520.89 |

| PROGRESSIVE | $524.78 |

| Co-Operative Ins Companies | $572.22 |

| NATIONWIDE | $580.11 |

| Geico | $623.89 |

| ALLSTATE | $944.67 |

| Concord Group | $1,072.56 |

| Union Mutual Fire Group | $1,519.76 |

City Rates

Depending on where you live, auto insurance premiums will fluctuate. From South Burlington to Colchester, you’ll see nearly a $200 shift. If you’re wondering what your neighbors are paying for car insurance in comparison to yourself, look at our findings below.

| Cost by City | |

|---|---|

| South Burlingron | $1,366.27 |

| Rutland City | $1,374.81 |

| Burlington | $1,394.67 |

| Brattleboro | $1,410.54 |

| Hartford | $1,428.59 |

| Colchester | $1,515.24 |

| Essex | $1,557.03 |

| Bennington | $1,564.27 |

| Milton | $1,579.30 |

Most Popular Vermont Car Insurance Providers

Market share shows the percentage of customers a company has in comparison to its competitors. Progressive has Vermont’s biggest share nearly 20% of all insured drivers. Geico isn’t far behind.

The important thing about market share is that it tells you a lot more than meets the eye about a company. Progressive is the most popular insurance company for auto coverage in Vermont, but it’s the third cheapest option on average. This indicates that customers are more willing to pay for its policies for some other reason. Maybe it’s good customer service or offerings, but think about it when you compare companies below.

| Most Popular | |

|---|---|

| PROGRESSIVE GRP | 16.13 |

| Geico | 13.25 |

| LIBERTY MUT GRP | 8.44 |

| STATE FARM GRP | 8.09 |

| ALLSTATE INS GRP | 6.57 |

| CONCORD GRP | 5.54 |

| UNITED SERV AUTOMOBILE ASSN GRP | 4.38 |

| HARTFORD FIRE & CAS GRP | 4.37 |

| NATIONWIDE CORP GRP | 4.32 |

| VERMONT MUT GRP | 4.13 |

Read More: Vermont Mutual Insurance Reviews

Customer Satisfaction Ratings

A “complaint index” shows the percentage of customers who complain compared to the amount an insurance company has. Ratios of zero are the best and mean that very few customers are complaining about a company. Ratios about 1.0 are where it starts to become worrisome.

| Best Customer Service | # of Complaints | Complaint Ratio | |

|---|---|---|---|

| Geico | $40,343,000 | 0 | 0 |

| Progressive | 50,729,000 | 12 | 0.24 |

| Concord General Mutual Insurance | 19,225,000 | 6 | 0.31 |

| Liberty Mutual | 26,894,000 | 10 | 0.37 |

| Nationwide | 14,528,000 | 7 | 0.48 |

| USAA | 13,503,000 | 7 | 0.52 |

| State Farm | 26,467,000 | 17 | 0.64 |

| Hartford | 14,630,000 | 10 | 0.68 |

| Allstate | 21,633,000 | 18 | 0.83 |

| Vermont Mutual Insurance | 13,901,000 | 15 | 1.08 |

You’ll see that in Vermont, Geico has the lowest complaint ratio. Since the rest of the companies on the chart below have scores lower than 1.0, they’re also pretty good at keeping their customers happy. If you’re considering any of these Vermont auto insurance companies, they’ll all be pretty good in the customer service department based on this research.

Our Recommendation

We aren’t here to tell you what to do. We’re here to bring you relevant and in-depth information so you can make the best insurance decision for yourself. When doing so, we only recommend that you go with a company that has great standings in a number of categories. Geico for instance ranks in the top five for cheapest average premiums, market share, and complaint index. Progressive is also close behind. Go with a company like these two and you should be in good shape.

If you still have questions or are ready to compare quotes, give an agent a call. They know everything about Vermont car insurance companies and how to find the best rates.

Where We Found The Facts

All of the facts you see here were gathered through intense research and data calculation. Since we did use very specific driver profiles for these rates, they may not match what you’ll pay for auto insurance. Our aim was to provide you with averages for auto insurance by groups of people, but just know that yours might be different unless you match the drive information exactly.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Source Links:

- ratekick.com

- valuepenguin.com