It might sound too good to be true, but we spend our time tracking down New Mexico’s most affordable car insurance companies or you. If you’ve seen a UFO, are one of the Four Corners of the U.S., and are proud of that “bad” TV show that put your state on the map, this resource is for you.

We know car insurance can be confusing. Some people just want to know how much coverage they’re required to have. Others want to protect themselves and their families without spending a small fortune on insurance premiums.

The average cost of auto insurance in New Mexico is low compared to some areas. It’s largely dependent on where you shop and things like your driving record. Even if your record is not perfect, though, you can find cheap car insurance.

What Are You Looking For?

- Cheapest Companies In New Mexico

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Car Insurance Companies In New Mexico

- Customer Satisfaction Ratings

- Our Recommendation

Who Are The Cheapest Companies In New Mexico?

We looked at four driver profiles with New Mexico state minimums and zero driving violations who drive a Honda Civic Si 15,000 miles a year to find the cheapest car insurance for the average driver. Geico, USAA, AAA, and Allstate top our list of the most affordable options–all being less than $600 a year. Here are the average car insurance premiums by company you might pay if you live in New Mexico.

| Average Quotes | |

|---|---|

| Geico | $377.46 |

| USAA | $424.78 |

| AAA | $505.65 |

| Allstate | $573.16 |

| Iowa Farm Bureau | $602.38 |

| Nationwide | $683.57 |

| Progressive | $708.75 |

| State Farm | $728.81 |

| Safeway Insurance | $793.45 |

| Farmers | $846.52 |

| 21st Century | $855.73 |

| Loya Insurance | $861.85 |

| MetLife | $904.00 |

| Safeco | $997.33 |

| The Hartford | $1,185.73 |

| Titan | $1,248.25 |

| Liberty Mutual | $2,004.48 |

Of course, these are sample rates. Your rates could vary if you have a clean driving record, higher bodily injury liability and property damage liability limits, and more. Each driver has a unique profile that factors into the cost of auto insurance. So you should always get a few quotes to compare your options. This just shows how it may balance out.

Read more: Comparing AAA And Allstate: Making The Right Choice For You

How Much Do Drivers Like You Spend On Auto Insurance?

We researched different drivers types that might better fit you and your lifestyle. Check out premiums by driver type to get a better idea of what you might pay for coverage in New Mexico.

Cheapest For Drivers Under 25

We used information from the driver profiles of 21-year old men and women to come up with these quotes, but they should help you see what people your age pay for auto coverage in New Mexico. Geico and USAA are again the clear winners. Because USAA is only available to military members and their families, Geico is the best option for the largest portion of New Mexico drivers.

| Average Quotes | |

|---|---|

| Geico | $447.41 |

| USAA | $493.88 |

| AAA | $637.90 |

| Allstate | $674.14 |

| Iowa Farm Bureau | $777.07 |

| Nationwide | $821.70 |

| Progressive | $900.90 |

| State Farm | $906.10 |

| Safeway Insurance | $907.50 |

| Farmers | $985.89 |

| 21st Century | $1,024.03 |

| Loya Insurance | $1,033.20 |

| MetLife | $1,230.40 |

| Safeco | $1,290.99 |

| Titan | $1,550.30 |

| The Hartford | $1,609.80 |

| Liberty Mutual | $2,355.60 |

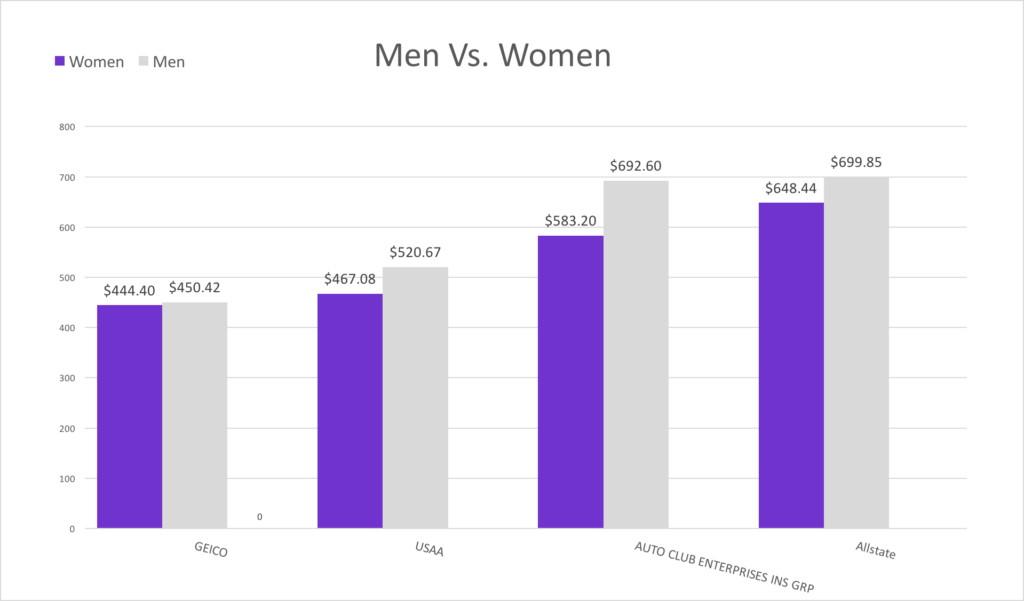

21-Year Old Men Vs Women Drivers

Like we just said, guys end up paying about 13% more for car insurance as 21-year old drivers. Some states have laws against basing premiums on sex or gender. Men still typically pay a little more, though. Here is how the cheapest companies rates compare between sexes.

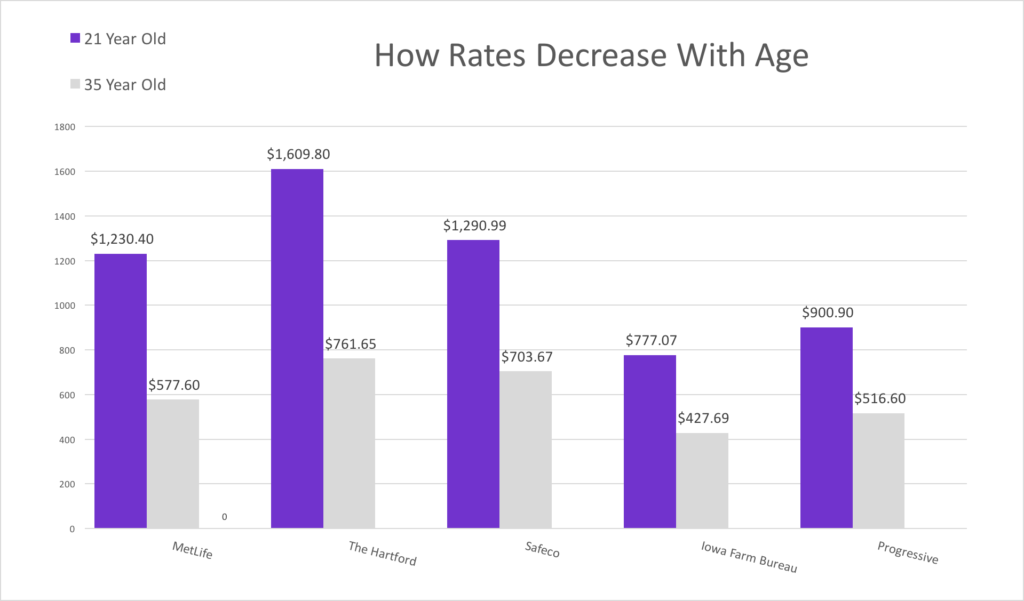

Cheapest For Gen X

Gen X, you guys will see some pleasant car insurance premium averages for your age bracket. From your early 20s until you turn 35, your rates will drop about 37%! This is assuming you have a clean driving record. Insurance companies can be more confident you have experience driving making you a lower risk.

Starting with the cheapest, Geico, you can get a policy for as little as $300 a year. See where else you’ll find affordable coverage below.

| Average Quotes | |

|---|---|

| Geico | $307.52 |

| USAA | $355.68 |

| AAA | $373.40 |

| Iowa Farm Bureau | $427.69 |

| Allstate | $472.18 |

| Progressive | $516.60 |

| Nationwide | $545.44 |

| State Farm | $551.52 |

| MetLife | $577.60 |

| Safeway Insurance | $679.40 |

| 21st Century | $687.44 |

| Loya Insurance | $690.50 |

| Safeco | $703.67 |

| Farmers | $707.15 |

| The Hartford | $761.65 |

| Titan | $946.20 |

| Liberty Mutual | $1,653.35 |

*These premiums were determined by looking at the profiles of men and women who were 35-years old.

What Are The Premium Differences By Age?

Between 21 and 35, you’ll see a big drop in insurance rates. That’s because younger drivers have more risk than ones with more experience. See how much your rates can change over time by looking at the following table.

Cheapest For Families With A Teen Driver

Having a family comes with a price tag. Lucky for you, we’ve found the cheapest average rates by insurance company for a married couple with a teen driver. Based on married couples with a 17-year old son, here are the average rates we found for your age group:

| Average Quotes | |

|---|---|

| Geico | $293.23 |

| AAA | $338.00 |

| FARM BUREAU | $372.80 |

| USAA | $375.02 |

| Progressive | $441.00 |

| MetLife | $509.00 |

| State Farm | $562.31 |

| Nationwide | $601.66 |

| Allstate | $619.85 |

| Safeway | $698.00 |

| The Hartford | $717.25 |

| Farmers | $741.71 |

| LOYA | $890.54 |

| Liberty Mutual | $1,498.64 |

Cheapest For Drivers Over 60

The rates are dropping like flies, people! It’s because as you get older, your premiums tend to go down. This is all based on the profile of a 65-year old man, but it’ll give you a rough estimate of what people over 60 pay for car insurance in New Mexico.

| Average Quotes | |

|---|---|

| Geico | $884.76 |

| USAA | $1,221.24 |

| FARM BUREAU | $1,361.27 |

| AAA | $1,503.15 |

| MetLife | $1,515.54 |

| Nationwide | $1,961.42 |

| State Farm | $1,981.37 |

| Progressive | $2,009.37 |

| Allstate | $2,233.97 |

| Safeway | $2,236.00 |

| LOYA | $2,492.40 |

| Farmers | $2,640.65 |

| The Hartford | $3,335.21 |

| Liberty Mutual | $4,793.51 |

City Rates

From Socorro to Albuquerque, you’ll only drive about an hour, but you’ll see car insurance rates climb by the hundreds. If you’re curious what your neighbors pay for auto coverage on average, take a look.

| Average Quotes | |

|---|---|

| Socorro | $682.91 |

| Clovis | $705.03 |

| Las Cruces | $709.79 |

| Roswell | $728.04 |

| Farmington | $749.57 |

| Taos | $832.56 |

| Santa Fe | $836.81 |

| Rio Rancho | $849.91 |

| Albuquerque | $895.75 |

| Gallup | $913.11 |

Most Popular Arkansas Car Insurance Providers

You say “popularity,” we say “market share.” To us, they’re kind of one in the same because market share measures the percentage of customers a company has compared to competitors. In New Mexico, State Farm reigns supreme with nearly 25% of all insured drivers as customers.

The reason why this section is important comes right now… Did you notice that State Farm isn’t the cheapest car insurance option for the average driver in New Mexico? In fact, it’s the eighth cheapest provider. That means that more people are going with the company for another reason. This could be good customer service or better coverage, but looking at market share can tell you more than meets the eye.

| Premiums Written | Market Share | |

|---|---|---|

| State Farm | 237,659 | 20.37 |

| Farmers | 151,984 | 13.03 |

| Geico | 140,022 | 12 |

| Progressive | 117,155 | 10.04 |

| Allstate | 97,480 | 8.35 |

| USAA | 97,134 | 8.32 |

| Liberty Mutual | 59,638 | 5.11 |

| The Hartford | 42,767 | 3.67 |

| Dairyland | 40,013 | 3.43 |

| Loya Insurance | 26,494 | 2.27 |

Read more: Arkansas Cheapest Car Insurance

Customer Complaints

A “complaint index” measures the percentage of customer complaints compared to a company’s market share. Companies like Liberty Mutual with a score of zero are the best at keeping customers happy. USAA has the highest in this chart, but that’s still a very low customer complaint index.

The reason why this is important is that it tells you as a customer how other policyholders like doing business with an insurance company. If there are less complaints, there is also less of a chance that you’ll find yourself unhappy with a company’s service.

| Number of Complaints | Complaint Ratio | |

|---|---|---|

| Liberty Mutual | 0 | 0 |

| Allstate | 2 | 0.021 |

| Geico | 3 | 0.024 |

| The Hartford | 1 | 0.024 |

| Sentry | 1 | 0.024 |

| Progressive | 3 | 0.027 |

| Farmers | 5 | 0.031 |

| State Farm | 7 | 0.031 |

| Loya | 1 | 0.039 |

| USAA | 5 | 0.054 |

Our Recommendation

You’re the only you, so you are the only one who can make insurance decisions for yourself. The one thing we can do here is give you all the information you need to make a fantastic car insurance decision.

We do have one piece of advice and that’s to pick a company with all-around great rankings. Allstate is one of these for sure because it ranks fourth for cheapest coverage, has the fifth highest market share, and is second for customer services (based on complaint index). Geico is the cheapest option, comes in third for most popular choice, and is third in customer service. USAA also did very well as the state’s second cheapest, sixth most popular (remember, it’s for military members only so this has something to do with it), and ranks 10th in customer service.

Now, you have to weigh what’s most important to you. If it’s budget, maybe go with a company like Geico because it still has great scores in other categories. If it’s best customer service, pick an insurance provider like Allstate. It’s really up to you, but the main thing to take away from this is to always pick a company that’s great across the board.

Need some help? Don’t worry. There’s a whole team of insurance-loving people who can help find answers to your questions and quotes.

Where We Found The Facts

We did a lot of research to find this information and you can even check for yourself by following the links below. The only thing that might not be true for you though are the average premiums. Since all car insurance quotes use such specific data to come up with premiums, you won’t come back with these numbers unless you match the profiles we surveyed exactly. The only reason we gave averages is to show you examples of what people like you pay, but you’ll have to call for a quote to get a 100% accurate price.

Source Links:

Source Links:

- New Mexico Department of Insurance