Fun fact for you Indianans: Colonel Sanders is from Indiana and also worked in insurance before opening his famous chicken joints. That’s not all the cool info we have here either. We have the down low on average car insurance premiums by company, customer complaint breakdowns, and much more. If you have a special place in your heart for Rudy, that famously loud and long car race, and the Hoosiers, this car insurance information page is for you.

What Are You Looking For?

- Indiana’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Car Insurance Companies In Indiana

- Customer Satisfaction Ratings

- Our Recommendation

What are the cheapest car insurance companies in Indiana?

After looking at 20 cities, eight driver profiles, and six insurance companies, we were able to calculate the average rates per auto insurance company. We found that–based on the profiles we used–the average Indiana driver pays $863 a year for car insurance. Do you need to pay that much? Maybe not. For example, Erie Insurance’s average rates are almost 50% than the state average.

For all profiles, we based pricing off of someone who drove a 2013 Honda Civic LX (4-door), had good credit, and no accidents. If this sounds like you, see what you could be paying for Indiana car insurance with our data below.

| Average Annual Rate | |

|---|---|

| State Average | $863.00 |

| Erie Insurance | $458 |

| Indiana Farmers Mutual Insurance | $571 |

| Allstate | $882 |

| Liberty Mutual | $1,023 |

| Travelers | $1,084 |

| Geico | $1,164 |

How much drivers like you spend on auto insurance?

We looked into specific driver profiles so we can give you a better idea of what a person like you can expect to pay for car insurance in Indiana. Take a look.

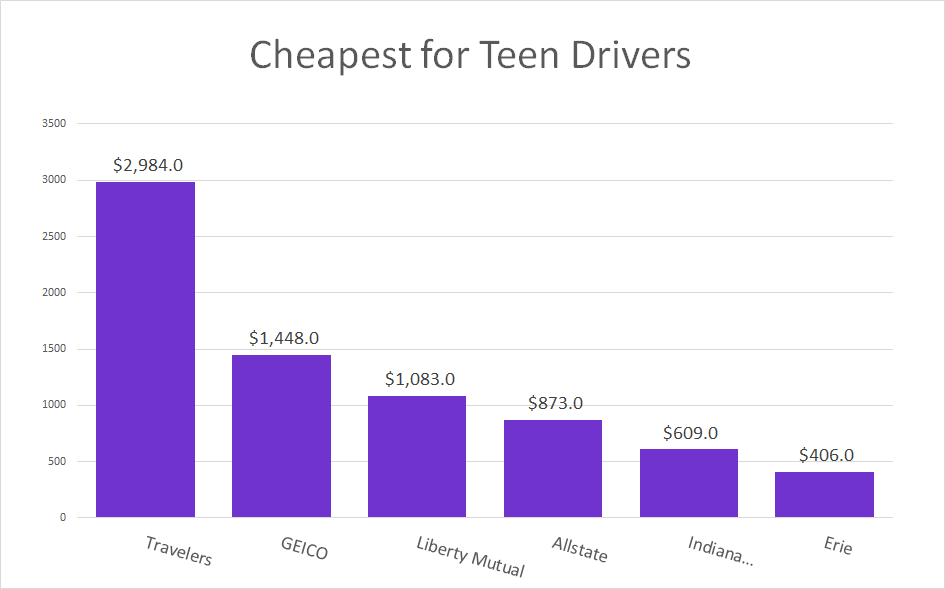

Cheapest For Teen Drivers

We analyzed the profiles of 18-year old girls and boys to find the cheapest car insurance premiums in Indiana. Here they are:

| Average Annual Rate | |

|---|---|

| Erie | $406 |

| Indiana Farmers Mutual | $609 |

| Allstate | $873 |

| Liberty Mutual | $1,083 |

| Geico | $1,448 |

| Travelers | $2,984 |

Girl Teens Vs Boy Teens When It Comes To Premiums

Teenage boys pay 35% more for car insurance than teen girls. That could be because of statistics that show boys that age get into more accidents than girls. Regardless, take a look at the chart below to find out how much you could pay for car insurance.

Cheapest For Young Adults

Once you turn 25, your rates will be exponentially lower than on your sweet 16. In fact, our data shows that rates drop about 33% between 18 and 25. Travelers has an even steeper drop—83%. The difference between what men and women pay for auto insurance policies also starts to even out. These rates are based on 25-year old men and women, but they’ll give you a rough estimate of what you can expect to pay.

| Average Annual Rate | |

|---|---|

| Travelers | $510 |

| Erie | $551 |

| Indiana Farmers Mutual Ins | $629 |

| Allstate | $930 |

| Geico | $1,172 |

| Liberty Mutual | $1,176 |

Read more: Does Car Insurance Drop at 25?

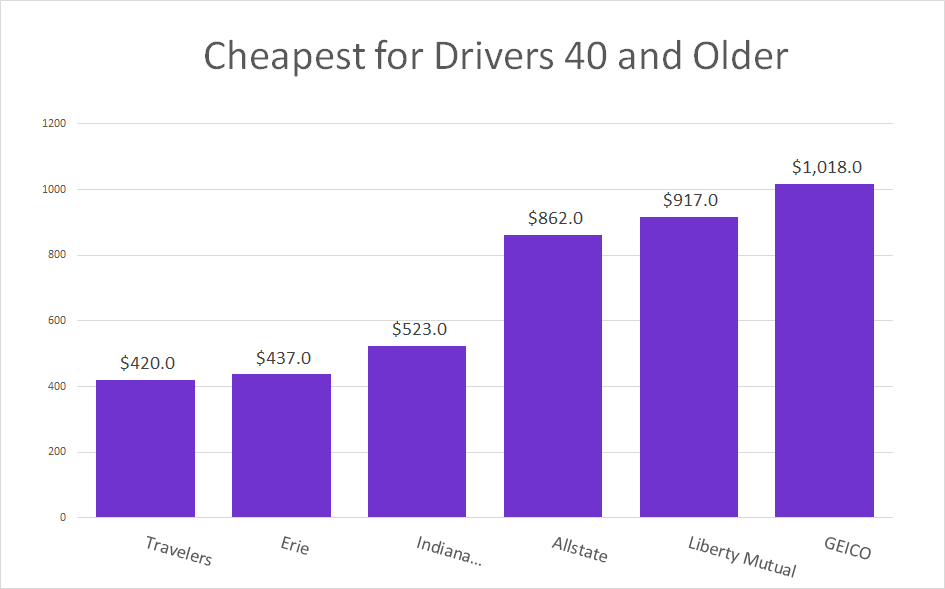

Cheapest For Drivers 40 And Older

You’ll pay about 6% less for auto insurance coverage once you hit 40 compared to what you paid in your 20s. According to our calculations, Liberty Mutual and Erie drop the most once you’re 40—about 22% for both. Check out the rates below to see the averages for your age group.

Average Premiums: Men Vs Women

We looked at driver profiles of men and women who were 18, 25, 40, and 60 and found that men pay quite a bit more across the board. For example Travelers male customers pay 37% more than its women policy holders. Here are how much men and women will pay for car insurance on average compared to one another in Indiana.

| Females | Males | |

|---|---|---|

| ERIE | $437 | $478 |

| INDIANA FARMERS MUTUAL INS | $555 | $587 |

| ALLSTATE | $842 | $921 |

| LIBERTY MUTUAL | $962 | $1,084 |

| Geico | $1,159 | $1,168 |

| TRAVELERS | $914 | $1,253 |

Read more: Finding The Best Auto Insurance For 60-Year-Olds

Average Premiums: Single Vs Married

Using driver profiles for single men and women who were 18 and 25 compared to married men and women who were 40 and 60, we found rate comparisons. Take a look below.

| Married | Single | % More Single Drivers Pay | |

|---|---|---|---|

| Allstate | $829 | $901 | 9% |

| Erie | $432 | $479 | 11% |

| Geico | $1,023 | $1,310 | 28% |

| Indiana Farmers Mutual Insurance | $523 | $619 | 18% |

| Liberty Mutual | $842 | $1,129 | 34% |

| Travelers | $408 | $1,747 | 328% |

*Some of this disparity between numbers could be the fact that the younger drivers we ran the numbers for normally spend more than older drivers do on car insurance. Regardless, it’s good to see how your marital status can affect your rate.

Read more: Finding The Best Auto Insurance For 25-Year-Olds

What are the city rates?

Depending on where you live in Indiana, you’ll probably pay a different premium for auto coverage than your neighbor. Take Lafayette and Gary for instance. Only about 90 miles apart, we found that you’ll pay $500 more a year for coverage in Gary than in Lafayette. Take a look at the city averages to get an idea of what you might pay for auto coverage.

| Insurance Rates by City | Average Annual Rate |

|---|---|

| Lafayette | $713 |

| Noblesville | $741 |

| Bloomington | $751 |

| Mishawaka | $757 |

| Carmel | $758 |

| Greenwood | $766 |

| South Bend | $777 |

| Fort Wayne | $794 |

| Muncie | $797 |

| Pine Village | $818 |

| Fishers | $825 |

| Otwell | $825 |

| Bristol | $845 |

| Terre Haute | $851 |

| Anderson | $876 |

| Kokomo | $892 |

| Evansville | $964 |

| Indianapolis | $1,049 |

| Hammond | $1,207 |

| Gary | $1,265 |

What are the most popular Indiana car insurance providers?

Market share shows the percentage of customers a company has compared to competitors. If you choose the most popular insurance company—in Indiana’s case, State Farm—you might notice that it’s not the cheapest option. Cheap doesn’t always mean great and looking at market share can give you a clue about why so many other drivers are choosing a certain car insurance provider. Give the chart below a look to see for yourself.

| Premiums Written | Market Share Percentage | |

|---|---|---|

| State Farm | 760,155 | 24.5 |

| Progressive | 315,350 | 10.16 |

| Indiana Farm Bureau | 246,597 | 7.95 |

| Allstate | 243,700 | 7.85 |

| Geico | 168,170 | 5.42 |

| American Family | 141,566 | 4.56 |

| Liberty Mutual | 129,825 | 4.18 |

| Erie Insurance | 102,482 | 3.3 |

| Farmers | 81,576 | 2.63 |

| Nationwide | 74,664 | 2.41 |

What are the customer satisfaction ratings?

What you’re looking at below is called a “complaint index.” It shows the percentage of customers who complain about a company compared to its market share. Lower numbers mean less people are complaining and higher numbers mean more customers have negative things to say.

| # of Complaints | Complaint Ratio Per 1,000,000 | |

|---|---|---|

| Progressive | 7 | 0.02 |

| Erie Ins | 4 | 0.04 |

| State Farm | 32 | 0.04 |

| American National | 11 | 0.04 |

| Allstate | 10 | 0.05 |

| Shelter Ins | 1 | 0.05 |

| Illinois Farmers Ins Co | 3 | 0.06 |

| Hartford | 1 | 0.06 |

| Farmers | 2 | 0.06 |

| USAA | 3 | 0.07 |

| American Family | 9 | 0.07 |

| Grange Mutual | 2 | 0.08 |

| Automobile Club MI | 1 | 0.08 |

| Geico | 15 | 0.09 |

| Nationwide | 5 | 0.10 |

| Travelers | 3 | 0.12 |

| Hanover Ins | 2 | 0.12 |

| Motorsts Mutual | 1 | 0.12 |

| CSAA | 4 | 0.12 |

| Selective Ins | 2 | 0.16 |

| Esurance | 3 | 0.17 |

| State Auto Mutual | 3 | 0.17 |

| American Standard | 2 | 0.18 |

| Westfield Ins | 1 | 0.18 |

| Amica Mutual | 1 | 0.20 |

| Alfa Ins | 3 | 0.24 |

| Liberty Mutual | 7 | 0.29 |

| Wolverine Mutual | 1 | 0.30 |

| Western National | 2 | 0.36 |

| 21st Century | 2 | 0.37 |

| Pennsylvania National Ins | 7 | 0.38 |

| Safe Auto Ins | 11 | 0.43 |

| Pekin Ins | 1 | 0.44 |

| American Access Casualty Company | 5 | 0.47 |

| Affirmative Ins | 4 | 0.66 |

| Omni | 2 | 0.96 |

| First Acceptance | 7 | 1.07 |

| AssuranceAmerica | 4 | 1.14 |

| Unique Ins | 15 | 2.22 |

| American Independent | 1 | 2.55 |

| Chubb | 1 | 3.45 |

| United Automobile Ins | 2 | 4.46 |

Progressive has the lowest and best complaint index in the state which means it probably has some of the happiest customers. Chubb, United Automobile, and American Independent all are pretty sub-par on this scale.

If you’re looking for a new provider for auto coverage, make sure they have a low or moderate complaint index so you’ll be more likely to enjoy its coverage.

Our recommendation

We hope you use all the facts and data above to pick the best all-around company that fits your needs. Allstate, for instance, ranks in the top five in Indiana for price, market share, and low customer complaints. Erie and Allstate both ranked in the top five for two of those categories.

Make a choice on a provider that has great scores across multiple categories or let the experts help you. Licensed agents can answer your questions about Indiana car insurance and help you shop around for quotes. If you Hoosiers are ready to get started, call [mapi-phone /] now.

Where We Found The Facts

We sourced all of these facts and quotes from credible sources (you can check them out below) and turned them into easy information you can understand. We used driver profiles of people who who drove a 2013 Honda Civic LX (4-door), had good credit, and no accidents. You’re unique, so your premium might be a little bit different depending on your life and driving history. The reason why we wanted to show you sample premiums is so you’ll know a range of what to expect when you start shopping for auto coverage. Just know that your premium could be higher or lower depending on specific facts about you, and this information is only to be used for reference.

Source Links: