Searching for car insurance information in Connecticut? We have it all here from cheapest rates by company to what cities pay the most for auto coverage. If you love those Huskies and fabulous falls, this is the car insurance guide you’ve been hunting for.

What Are You Looking For?

- Connecticut’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Connecticut Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What Is Connecticut’s Cheapest Auto Insurance Company?

We ran the numbers for 10 cities, and eight driver profiles of people who have a 2013 Honda Civic LX (4-door), good credit, and no accidents on record. After calculating average premiums, we found that depending on which insurance company you select, you’ll spend about 225% when comparing the cheapest to the most expensive provider. According to our research, Safeco comes in as the most affordable. At less than $71 a day, it’s about 24% more affordable than the second cheapest–Atlas Insurance. See the full list of cheapest to most expensive options for average drivers below so you don’t overpay without realizing it.

| Cheapest Insurance in Connecticut | |

|---|---|

| Safeco | $848.93 |

| Atlas | $1,060.00 |

| Allstate | $1,135.37 |

| Nationwide | $1,272.63 |

| Dairyland | $1,364.00 |

| Travelers | $1,392.67 |

| Progressive | $1,483.63 |

| Amica Mutual | $1,493.97 |

| Geico | $1,541.05 |

| Liberty Mutual | $1,608.68 |

| Citizens | $2,745.44 |

The basic coverage and deciding factors were the same with all these carriers. Different insurers place greater importance on different factors. Some companies also have more discounts you can take advantage of, but you have to select them.

How Much Do Drivers Like You Spend On Auto Insurance?

If you’re not an “average driver,” you might find this section useful. That’s because we also calculated premiums for specific driver types so you can get a better idea of what you might pay for auto coverage. Remember, your rates will probably be a tad different based on what car you drive and your driving history, but this will give you a pretty good idea of what you’ll pay in Connecticut for the state’s minimum amount of car insurance.

Cheapest by Sex

We looked at male driver profiles for single guys who were 18 and 25 and married male drivers who were 40 and 60. We found that men pay about 8.5% more for auto insurance than women. After looking at insurance quotes for single women who were 18 and 25 and married women who were 40 and 60, we found the cheapest premiums on average per company by gender. Safeco is the most affordable for both men and women. Because women may be seen as a less risky profile to insure, average rates are about $75 cheaper for women.

Just to show you side-by-side how much car insurance rates vary from men to women, we made a little chart for you. Check it out:

| Male | Female | ||

|---|---|---|---|

| Safeco | $885.75 | Safeco | $812.10 |

| Allstate | $1,191.45 | Atlas | $1,060.00 |

| Nationwide | $1,305.50 | Allstate | $1,077.85 |

| Dairyland | $1,364.00 | Nationwide | $1,239.75 |

| Travelers | $1,388.67 | Amica Mutual | $1,367.74 |

| Geico | $1,438.20 | Travelers | $1,396.36 |

| Progressive | $1,540.55 | Liberty Mutual | $1,397.50 |

| Amica Mutual | $1,617.05 | Progressive | $1,426.70 |

| Liberty Mutual | $1,819.85 | Geico | $1,643.90 |

| Citizens | $2,851.90 | Citizens | $2,636.26 |

Cheapest For Teen Drivers

After looking at driver profiles of men and women who are 18, these are the cheapest options in Connecticut:

| Cheapest for Teens | |

|---|---|

| Safeco | $1,344.90 |

| Allstate | $1,618.70 |

| Liberty Mutual | $1,973.40 |

| Amica Mutual | $2,380.21 |

| Geico | $2,472.60 |

| Citizens | $3,090.60 |

| Progressive | $3,462.60 |

| Travelers | $3,965.20 |

Read more:

- Comparing Geico And Amica: Making An Informed Choice

- Comparing Amica And Progressive: Which Insurance Provider Is Right For You?

Prices For Teen Boys Vs Teen Girls

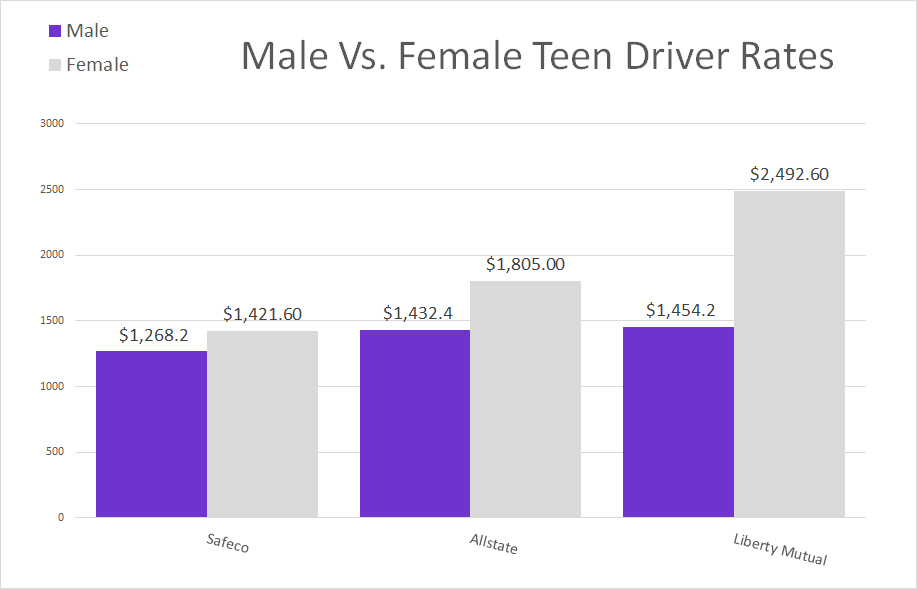

Teen boys and girls won’t pay the same for car insurance. This chart is to show you how guys can pay anywhere from $150-$1,000 more for insurance compared to the ladies who have the exact same coverage.

In some states, cheap car insurance factors in sex. In other states, rates between boys and girls are still different due to driving history and other factors.

Cheapest For Young Drivers

We took rate averages for men and women who were 25 and found some great premiums. At age 25, your rates drop about 44% from when the time you were a teenager. From cheapest to most expensive, you’ll see a 400% jump!

| Cheapest for Young Adults | |

|---|---|

| Travelers | $797.20 |

| Safeco | $837.70 |

| Progressive | $1,002.30 |

| Allstate | $1,032.50 |

| Amica Mutual | $1,245.80 |

| Nationwide | $1,441.50 |

| Geico | $1,487.40 |

| Liberty Mutual | $1,851.00 |

| Citizens | $3,025.78 |

Men In Their 20s Vs Women In Their 20s

We weren’t sure if the numbers above would be enough for you. So we did you the favor of putting rates side-by-side so you can see how much you’ll pay for car insurance as a man or woman in your 20s. Take a look.

| Cheapest 3 for Women, aged 25 | Cheapest for Men, aged 25 | ||

|---|---|---|---|

| Travelers | $763.00 | Travelers | $831.40 |

| Safeco | $820.00 | Safeco | $855.40 |

| Progressive | $967.40 | Geico | $975.60 |

Cheapest For Married Couples

That old ball and chain can actually help you save on car insurance! Married couples pay about 40% less than single drivers at around $1,100 a year. While we based these rates on married men and women who were 40 and 60, it’s a good way to gauge your auto coverage rates in Connecticut if you’re married too. Part of this is related to age. A lot of it has to do with the fact that married couples are more likely to own a house and can combine policies for more discounts on cheap car insurance.

| Cheapest for Married Couples | |

|---|---|

| Safeco | $606.55 |

| Travelers | $725.70 |

| Progressive | $734.80 |

| Allstate | $940.26 |

| Atlas | $1,060.00 |

| Geico | $1,102.10 |

| Nationwide | $1,188.19 |

| Amica Mutual | $1,197.10 |

| Liberty Mutual | $1,305.15 |

| Dairyland | $1,364.00 |

| Citizens | $2,454.00 |

Cheapest For Drivers Over 60

Drivers over 60 will pay 10% less for car insurance than married drivers in their 40s. See where you may find the cheapest coverage below:

| Cheapest for Drivers Over 60 | |

|---|---|

| Safeco | $556.80 |

| Progressive | $684.00 |

| Travelers | $733.00 |

| Geico | $843.00 |

| Allstate | $927.50 |

Do Auto Insurance Rates Vary by City?

Most drivers will pay a different rate for auto coverage. So will people who live in different Connecticut cities. While West Hartford and Hartford are neighbors, you’ll pay about $100 a year more for coverage in the west. The same goes for Bridgeport and New Haven. See for yourself below.

| Cheapest Insurance by City | |

|---|---|

| Bridgeport | $1,142.32 |

| New Haven | $1,273.44 |

| Danbury | $1,378.71 |

| Norwalk | $1,417.83 |

| Greenwich | $1,427.54 |

| Stamford | $1,483.46 |

| New Britain | $1,515.66 |

| Waterbury | $1,675.94 |

| Hartford | $1,834.18 |

| West Hartford | $1,925.19 |

Who Are The Most Popular Connecticut Car Insurance Providers?

When it comes to car insurance companies, popularity or what us insurance folk like to call “market share” is very important. It’ll show you how many customers in your state have policies with a certain carrier and can open your eyes to other stuff too. Despite what you might think, there’s no single thing that leads to a larger market share. Just like insurance companies (who consider multiple factors like credit score, clean driving record, etc.), customers also consider multiple factors.

Geico has Connecticut’s highest market share. This means it has the most customers out of any other car insurance company. It’s not the cheapest option out there though. In fact, it’s actually the ninth least expensive and has competitors who offer rates almost half as much as its own. Why do the most customers have policies with Geico then? It could be partly because Geico is well known. It could also be attributed to great customer service and individual adjusters and other agents who have reached out to improve the customer experience.

| Most Popular | Percentage | Premiums Written |

|---|---|---|

| Geico | 16.2 | 420,807 |

| Allstate | 12.27 | 318,740 |

| Liberty Mutual | 11.89 | 308,976 |

| Progressive | 7.84 | 203,625 |

| Travelers | 6.22 | 161,514 |

| State Farm | 5.33 | 138,385 |

| Nationwide | 4.7 | 121,997 |

| The Hartford | 4.27 | 110,926 |

| USAA | 4.03 | 104,795 |

| MetLife | 3.98 | 103,528 |

What Geico doesn’t have in price, it might make up for in customer service or coverage. The cheapest option isn’t always the best, and charts like the one below can shed light on that.

Read more: Key Factors To Consider When Calculating Auto Insurance Costs In Connecticut

How Do Customer Complaints Factor into Insurance Decisions?

A “complaint index” records all of a company’s customer complaints compared to its market share. If a company has a low number on the complaint index, it means less people are ranting. If they have higher numbers, more customers are not happy campers. While you might imagine price playing a role, customers are as likely to complain about bad service with low rates as they are if they pay more. If they pay a higher annual premium, they might just add that detail to the review on their insurance policy.

Federated Mutual Group through Chubb are all spectacular with zeroes, and the least amount of complaints. American Independent Insurance Group is the worst, but still not terrible compared to how high these numbers can get sometimes.

| BEST CUSTOMER SERVICE | CPI | Complaints |

|---|---|---|

| Federated Mut Grp | 0 | 1 |

| Allianz Ins Grp | 0 | 1 |

| Infininity Ins | 0 | 1 |

| Munich Re Grp | 0 | 1 |

| Electric Ins Grp | 0 | 1 |

| New London County | 0 | 1 |

| CNA Ins Grp | 0 | 1 |

| American Natl Fncl Grp | 0 | 1 |

| American Financial Grp | 0 | 1 |

| Selective Ins | 0 | 1 |

| Central Mut I C Oh | 0 | 1 |

| Tokio Marine Holdings Inc Grp | 0 | 1 |

| Wr Berkley Corp | 0 | 1 |

| CSAA INS | 0 | 1 |

| CHUBB Ins Grp | 0 | 1 |

| Amica Mut Grp | 0.02 | 16 |

| Country Ins & Financial Service | 0.021 | 17 |

| Main Street Amer Grp | 0.037 | 18 |

| Kemper Corp Grp | 0.041 | 19 |

| Progressive | 0.042 | 20 |

| Geico | 0.043 | 21 |

| State Farm | 0.044 | 22 |

| The Hanover Ins Grp | 0.044 | 22 |

| Utica Natl Ins Grp | 0.048 | 24 |

| Nationwide | 0.048 | 24 |

| Travelers | 0.048 | 24 |

| Allstate | 0.056 | 27 |

| American Intrnl Grp | 0.062 | 28 |

| Liberty Mut Grp | 0.062 | 28 |

| State Auto Mut Grp | 0.063 | 30 |

| Mapfre Ins Grp | 0.067 | 31 |

| Arbella Ins Grp | 0.073 | 32 |

| Metropolitan Grp | 0.086 | 33 |

| Qbe Ins Grp Ltd | 0.086 | 33 |

| Hartford Fire & Cas Grp | 0.099 | 35 |

| Amtrust Ngh Grp | 0.102 | 36 |

| USAA | 0.106 | 37 |

| Quincy Mut Grp | 0.109 | 38 |

| Zurich Ins Grp | 0.114 | 39 |

| Plymouth Rock Ins Grp | 0.131 | 40 |

| Farmers Ins Grp | 0.162 | 41 |

| Ameriprise Financial Grp | 0.165 | 42 |

| Sentry Ins Grp | 0.182 | 43 |

| Ace Ltd | 0.282 | 44 |

| American Independent Ins Grp | 0.778 | 45 |

Read more:

- Top Choice For Your Mapfre Insurance Review

- The Hanover Insurance: A Comprehensive Review

- Comparing USAA And Amica: A Comprehensive Review For Your Financial Needs

When you’re making your final decision about a car insurance company, make sure to look at how they treat their customers so you’ll have a better chance of being happy with a policy.

What Is Our Recommendation?

We want to give you all the information you need to know about Connecticut car insurance so you can make the best decision about a policy. Many people look at rates without understanding what goes into them or why they’re paying more for comprehensive coverage than they would for simple liability on bodily injury coverage and property damage. We believe customers can make informed decisions with the right information.

We do have one thing we always want to tell our readers: go with a company that has good scores or rankings across more than one category. If you’re looking for cheap, Safeco has great pricing across the board, but isn’t listed for market share or complaint index. Geico on the other hand, ranks in the top ten for market share, price, and customer satisfaction, making it a reasonable choice.

To find cheap insurance rates near you, enter your ZIP code below.

Where We Found The Facts

All the facts and figures you see here are as real as they come. You can check them out on the links below, or just take our word for it. The one thing that may not ring true for you are the premiums. We used real driver profiles, but customized every quoting process for a person with a 2013 Honda Civic LX (4-door), good credit, and no accidents. If that doesn’t match your life 100%, you’ll probably get a different quote. We just wanted to give you a ballpark idea of what you could pay for coverage in CT, USA so you’re not shooting in the dark here.

Source Links:

- Ratekick.com

- Connecticut Department of Insurance

- Motorcycle Industry Council