Ready to find all the car insurance information you need in one place? It’s all here. If you love your lakes and root for the Lions, this auto insurance information is for you Michiganians.

Michigan’s minimum coverage requirements for auto insurance include bodily injury liability coverage, property damage liability coverage. These are the minimum requirements for auto insurance coverage you need to drive legally in the state. However, liability insurance may not be enough for you. You may also wish to add collision coverage and comprehensive coverage to ensure you are fully protected. The combination of liability, collision, and comprehensive insurance is called full-coverage car insurance.

What Are You Looking For?

- Michigan’s Cheapest Companies

- How Much Drivers Like You Spend On Auto Insurance

- Specific City Rates

- Most Popular Michigan Car Insurance Companies

- Customer Satisfaction Ratings

- Our Recommendation

What are Michigan’s cheapest companies?

After looking at six companies, 25 cities, and eight driver profiles of people who have a 2013 Honda Civic LX (4-door), good credit, and no accidents on record, we were able to calculate the cheapest auto insurance premiums in Michigan. Since Progressive the cheapest is about two grand less than the most expensive Auto-Owners you’ll want to take a look.

| Michigan's Cheapest Car Insurance | Average Annual Cost |

|---|---|

| Progressive | $1,155.59 |

| Citizens | $1,723.37 |

| Frankenmuth | $1,773.42 |

| Grange Mutual | $1,938.63 |

| Nationwide | $2,150.28 |

| Auto-Owners Insurance | $3,089.29 |

Read More: Grange Insurance: Insurance Needs

How much do drivers like you spend on auto insurance?

“Average” not something that describes you as a driver? Never fear. We calculated premiums by driver type so you can get a better handle on what you could pay for auto insurance in Michigan based on drivers like you.

Cheapest For Teen Drivers

Teen drivers will have much different rates than 40-year old married people. Take a look at our data to see where teens may be able to find the cheapest auto rates in Michigan.

Most Affordable for Teens Average Annual Cost

Citizens $2,907.92

Grange Mutual $3,400.32

Frankenmuth Mutual $3,553.52

Auto-Owners Insurance $5,382.22

Progressive $5,816.00

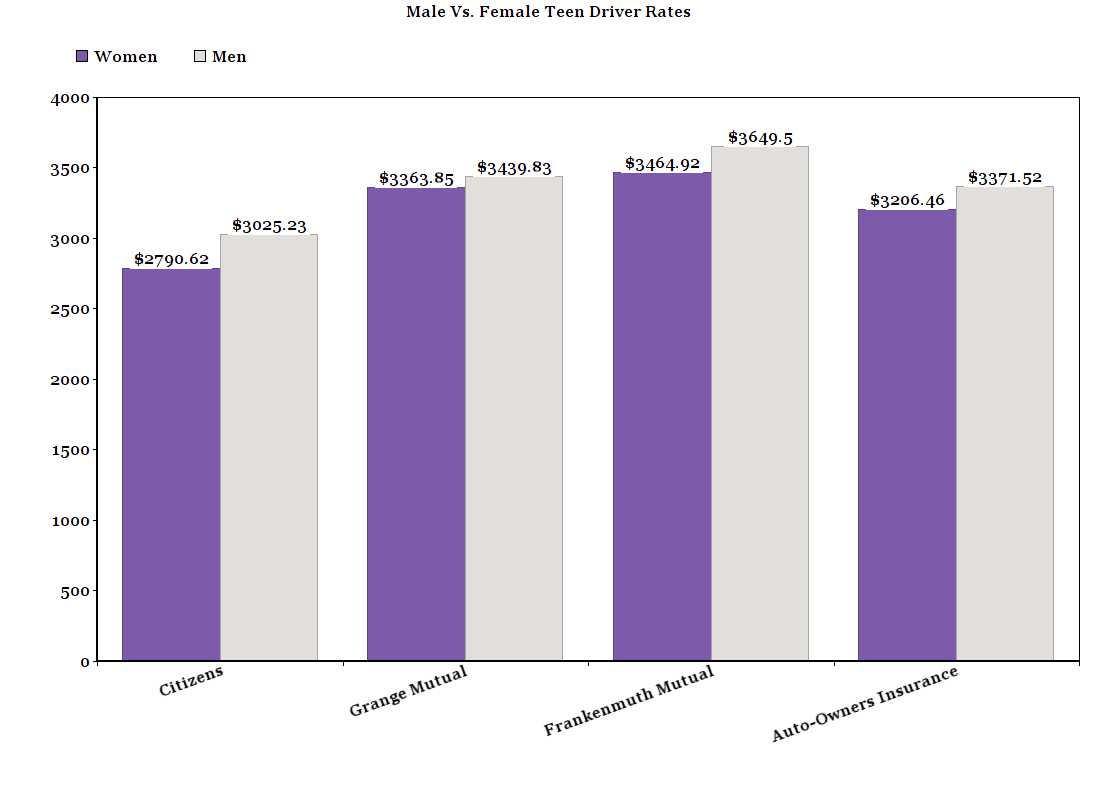

Male Vs Female Teen Driver Rates

Based on our research, men pay about 5% more for auto insurance than teenage girls. See how rates differ between girls and boys below and where both can find the cheapest coverage according to our findings.

Average Cost for Women Average Cost for Men

Progressive $1,236.50 $1,072.62

Citizens $1,703.36 $1,743.77

Frankenmuth Mutual $1,796.81 $1,750.04

Cheapest For Young Adults

When you turn 25, you’ll see a big difference in your premium compared to when you were a young 18-year old driver. Guys will see the biggest drop about 50% in rate reductions. Girls can enjoy a 42% drop in premiums. Take a look to see how much people in their 20s might pay for auto coverage in Michigan.

Most Affordable for Teens Average Annual Cost

Citizens $2,907.92

Grange Mutual $3,400.32

Frankenmuth Mutual $3,553.52

Auto-Owners Insurance $5,382.22

Progressive $5,816.00

Read more: Finding The Right Auto Insurance Coverage For Young Adults

*These rates are based on driver profiles of 25-year old men and women.

Cheapest For Drivers Over 60

We looked at driver profiles for men and women who were 60 and married and calculated the cheapest insurance options for that age group. Take a look if you’re in your 60s or older.

Most Affordable for Senior Citizens Average Annual Cost

Progressive $879.38

Frankenmuth Mutual $997.54

Citizens $1,215.70

Grange Mutual $1,478.37

Nationwide $1,915.23

Auto-Owners Insurance $2,435.77

Read more: Finding The Best Auto Insurance For 60-Year-Olds

How Rates Differ For Men And Women Drivers

Men pay about 13% less than women for car insurance in Michigan. We based this off of male and female drive profile averages for people who were 18, 25, 40, and 60, but it gives you a good idea of the differences in premiums regardless.

In addition to your age and gender, auto insurance companies also take your driving record and credit score into account when assigning your rate. If you’re having trouble finding cheap car insurance because you don’t have a clean record or you have a poor credit history, make sure to ask about insurance discounts. Auto insurance companies offer discounts for things like taking a defensive driving course, or for taking part in a usage-based insurance program. These programs use a mobile app to monitor your driving habits and allow you to save money just for driving safely. Most companies have multiple discount opportunities so make sure to take these into account while you’re comparison shopping for cheap auto insurance.

How much are auto insurance rates in the cities?

Turns out, Ann Arbor and Detroit are even more different than we thought. Rates from the two cities vary by thousands of dollars. You’ll find the same with other cities around Michigan too. Take a look to see what the average premium is in your neighborhood.

| Michigan's Cheapest Cities for Insurance | Average Annual Cost |

|---|---|

| Ann Arbor | $1,569.73 |

| Kalamazoo | $1,631.45 |

| St. Johns | $1,640.73 |

| Livonia | $1,693.33 |

| Grand Rapids | $1,697.45 |

| St. Clair | $1,730.50 |

| Utica | $1,733.24 |

| Macomb | $1,769.24 |

| Westland | $1,834.19 |

| Lansing | $1,858.96 |

| Troy | $1,876.10 |

| Farmington | $1,886.38 |

| Canton | $1,891.55 |

| Waterford | $1,930.18 |

| Taylor | $1,938.00 |

| Pontiac | $1,950.93 |

| West Bloomfield | $1,998.19 |

| Rochester Hills | $2,012.33 |

| Sterling Heights | $2,068.00 |

| Southfield | $2,161.81 |

| Flint | $2,258.29 |

| Warren City | $2,396.29 |

| Dearborn | $2,701.81 |

| Detroit | $3,055.89 |

| Royal Oak | $3,402.00 |

What are the most popular Michigan car insurance providers?

Ever heard of a term called, “market share?” It means the percentage of customers a company has compared to its competitors. State Farm has Michigan’s highest market share which means they’re the most “popular” option and have more customers than any other provider.

It’s important to look at because it can tell you a lot about a company. Progressive, for instance, is Michigan’s cheapest auto insurance provider for an average driver. It doesn’t have the most market share though. It actually is the fifth most popular company in the state. That means customers may be going to certain customers that cost more than other for different reasons like better customer service or coverage options.

Just take this into consideration when you’re looking for an auto insurance policy and see how a company’s popularity stacks up against other factors like cost. It could be that they’re worth the extra cash.

Market Share Percent

State Farm 18.36

Automobile Club of Michigan 16.11

Auto Owners Group 9.7

Allstate 9.55

Progressive 9.43

The Hanover Insurance Group 5.89

Michigan Farm Bureau 4.56

Liberty Mutual 4.28

Geico 3.05

USAA 2.41

What companies have the best customer satisfaction ratings?

A “complaint index” measures the percentage of customer complaints versus a company’s market share. Companies like Cincinnati Insurance with complaint indexes close to zero record the lowest amounts of complaints and companies like Meadowbrook have the most.

If you’re looking at a company, make sure they have a low complaint index because it means that more customers are happy and that you might have better odds of liking them too.

| # of Complaints | Premiums Written | Complaint Ratio | |

|---|---|---|---|

| Cincinnati Insurance | 2 | $68,579,973 | 0.03 |

| Acuity | 1 | $25,270,349 | 0.04 |

| Hastings | 2 | $49,546,695 | 0.04 |

| Pioneer State | 5 | $121,661,260 | 0.04 |

| Safeco | 5 | $101,753,579 | 0.05 |

| Auto Owners Group | 8 | $148,523,421 | 0.05 |

| Cherokee Insurance | 2 | $36,155,690 | 0.06 |

| Frankenmuth | 12 | $179,700,544 | 0.07 |

| Michigan Farm Bureau | 21 | $307,119,809 | 0.07 |

| Progressive | 53 | $765,070,504 | 0.07 |

| Liberty Mutual | 17 | $238,102,708 | 0.07 |

| Main Street America Group | 17 | $238,102,708 | 0.07 |

| Automobile Club of Michigan | 50 | $657,289,669 | 0.08 |

| USAA | 5 | $64,669,106 | 0.08 |

| Amica Mutual | 1 | $12,293,624 | 0.08 |

| Hanover | 1 | $11,921,301 | 0.08 |

| Travelers | 16 | $187,468,670 | 0.09 |

| Westfield | 4 | $46,580,649 | 0.09 |

| Citizens | 40 | $462,802,513 | 0.09 |

| State Auto Mutual Group | 131 | $1,432,776,638 | 0.09 |

| Atlas | 1 | $9,972,094 | 0.10 |

| Hartford | 10 | $98,748,447 | 0.10 |

| Titan | 5 | $48,426,517 | 0.10 |

| Secura Insurance | 3 | $27,252,270 | 0.11 |

| Geico | 29 | $237,098,870 | 0.12 |

| Metlife | 6 | $46,335,206 | 0.13 |

| Farmers | 21 | $160,603,972 | 0.13 |

| Zurich | 1 | $7,455,793 | 0.13 |

| Amtrust | 11 | $81,427,252 | 0.14 |

| Donegal Group | 6 | $43,313,428 | 0.14 |

| Allstate | 87 | $619,064,558 | 0.14 |

| Nationwide | 13 | $88,910,302 | 0.15 |

| Wolverine | 4 | $25,661,389 | 0.16 |

| Grange Mutual | 10 | $61,284,613 | 0.16 |

| Markel | 3 | $17,560,540 | 0.17 |

| American International | 1 | $5,541,958 | 0.18 |

| Lancer | 1 | $5,440,363 | 0.18 |

| Everest Rein | 5 | $26,440,498 | 0.19 |

| IDS | 8 | $37,139,519 | 0.22 |

| Amerisure | 1 | $3,960,972 | 0.25 |

| EMC Insurance | 2 | $7,620,799 | 0.26 |

| Michigan Millers | 10 | $37,023,370 | 0.27 |

| State Farm | 1 | $3,602,764 | 0.28 |

| 21st Century | 6 | $21,105,162 | 0.28 |

| Esurance | 42 | $127,090,122 | 0.33 |

| State National Group | 3 | $6,671,739 | 0.45 |

| National General | 6 | $11,983,278 | 0.50 |

| QBE | 1 | $1,667,706 | 0.60 |

| Dairyland | 1 | $1,647,560 | 0.61 |

| American Family | 1 | $1,467,197 | 0.68 |

| Meadownbrook | 1 | $1,047,666 | 0.95 |

What do we recommend?

Our only opinion is that we hope you guys go with an auto insurance provider that aligns most closely to your needs and priorities. We want to help you out along the way by giving you the best and most insightful information out there, but the choice should be up to you.

Now that we’ve said that, we will give you one piece of advice: go with a company that scores well across the board. In Michigan, Progressive is a good example of that because they rank in the top ten companies for premium pricing, market share, and complaint index. That means they’re doing everything either exceptionally or pretty darn well.

Still worried about what to do? There is a whole team of experts who can help. Give them a call to find auto insurance answers and quotes too.

Where We Found The Facts

Everything you’ve read here came from a lot of research around credible sources. The one thing that could be different for you though is your car insurance premium. We used specific driver profiles of people who drove a 2013 Honda Civic LX (4-door), had good credit, and no accidents on their records. If you don’t fit this description perfectly, you’ll probably get a different quote. We just wanted to be able to give you a sample of what people like you pay for auto coverage so you have a stepping stone to jump from.

Source Links:

- Ratekick.com